What are direct and indirect taxes, in your opinion? Explain why indirect taxes are viewed as regressive and direct taxes as progressive, using examples.

According to a recent RBI report, states like Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, etc. have a high debt burden. The cumulative debt of states has risen from 19.1 percent in 2018-19 to 25.1 percent in 2021-22. While fiscal stability of states is nRead more

According to a recent RBI report, states like Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, etc. have a high debt burden. The cumulative debt of states has risen from 19.1 percent in 2018-19 to 25.1 percent in 2021-22. While fiscal stability of states is necessary for sound sub-national fiscal health, there are persisting issues regarding it.

They are as follows:

- Declining revenues of states: The share of states’ own revenue has declined from 69 percent in 1955-56 to below 38 percent in 2019-20 due to slow pace of tax revenue growth. Also, there is a loss of autonomy on tax rates under the GST regime. Additionally, the COVID-19 pandemic has further impacted the tax revenues of states.

- High state expenditure: States have limited fiscal capacity and high share of committed expenditure for socio-economic development and populist measures like farm loan waiver, subsidies, etc. Other committed expenditures include interest payments on debt, pensions and administrative expenses.

- Implementation of Centrally Sponsored Schemes: It increases the burden on states to allocate their respective share for these schemes.

- Contingent liabilities: Due to the growing trend of using state PSUs, SPVs and other equivalent instruments for off-budget borrowings, the liabilities of states are increasing over time.

- High DISCOM losses: High debt levels of DISCOMS have been contributing to the debt burden of states.

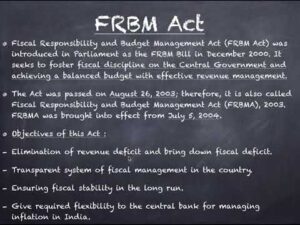

- Legal loopholes: State governments resort to extra-budgetary borrowings to finance their populist measures and this debt is concealed to circumvent the FRBM target.

Measures that need to be taken for long-term stability of state finances include:

- Improving fiscal discipline through expenditure prioritization, debt consolidation and FRBM compliance. The FRBM also needs to be amended to cover all the liabilities of the government.

- Cap excessive spending and borrowings at sectoral levels to avoid excessive populism, and their negative spill-overs on other areas.

- Rationalization of Centrally Sponsored Schemes to allow more flexibility to states and UT’s in their implementation to meet their domestic needs.

- Raising additional resources at the sub-national and national levels to increase the tax-to-GDP ratio, which is around 17 percent. Also, there is a requirement of addressing issues on GST compensation continuity, and shrinking of net divisible pool.

- There is a need to curb the black economy, as it erodes the fiscal pool of the government and leads to suboptimal spending.

See less

(FRBMA):-

(FRBMA):-

Direct tax is a type of tax where the incidence and impact of taxation fall on the same entity. In the case of direct tax, the burden cannot be shifted by the taxpayer to someone else. Income tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax. Indirect tax isRead more

Direct tax is a type of tax where the incidence and impact of taxation fall on the same entity. In the case of direct tax, the burden cannot be shifted by the taxpayer to someone else. Income tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax. Indirect tax is a levy where the incidence and impact of taxation do not fall on the same entity. The burden of tax can be shifted by the taxpayer to someone else. It is usually imposed on a manufacturer or supplier who then passes on the tax to the consumer. It is imposed on a product or service. Indirect tax has the effect of raising prices of products on which they are imposed. Goods and Services Tax (GST), customs duty etc. are examples of indirect taxes. Direct taxes are considered progressive because the government can impose a lower tax rate on low-income earners compared to those with a higher income. That means in direct taxes, it is possible to impose higher taxation rates for the rich and lower tax rate for the poor. It reduces the tax burden on people who can least afford to pay them and takes a larger percentage from high- income earners. For example, personal income tax in India has a higher tax rate for higher income slab. Indirect taxes are considered regressive in nature as they are applied uniformly to all taxpayers, regardless of their income level. For example, same rate of taxation is applied in case of GST, an indirect tax, on the same amount of goods or services purchased. If two individuals buy the same amount (say a packet of biscuits), both have to pay the same amount of tax. The GST, in effect, constitutes a higher percentage of the lower-earning individual’s wages and a lower percentage of the higher-earning individual’s wages. In this way, direct taxes facilitate higher burden of taxes on the rich acting as a tool of redistributive justice while indirect taxes affect the poor more. Therefore, increasing the indirect taxes is considered as a regressive step while imposing direct taxes as per income level of the taxpayer is considered as progressive tax.

See less