What are direct and indirect taxes, in your opinion? Explain why indirect taxes are viewed as regressive and direct taxes as progressive, using examples.

- Recent Questions

- Most Answered

- Answers

- No Answers

- Most Visited

- Most Voted

- Random

- Bump Question

- New Questions

- Sticky Questions

- Polls

- Followed Questions

- Favorite Questions

- Recent Questions With Time

- Most Answered With Time

- Answers With Time

- No Answers With Time

- Most Visited With Time

- Most Voted With Time

- Random With Time

- Bump Question With Time

- New Questions With Time

- Sticky Questions With Time

- Polls With Time

- Followed Questions With Time

- Favorite Questions With Time

Mains Answer Writing Latest Questions

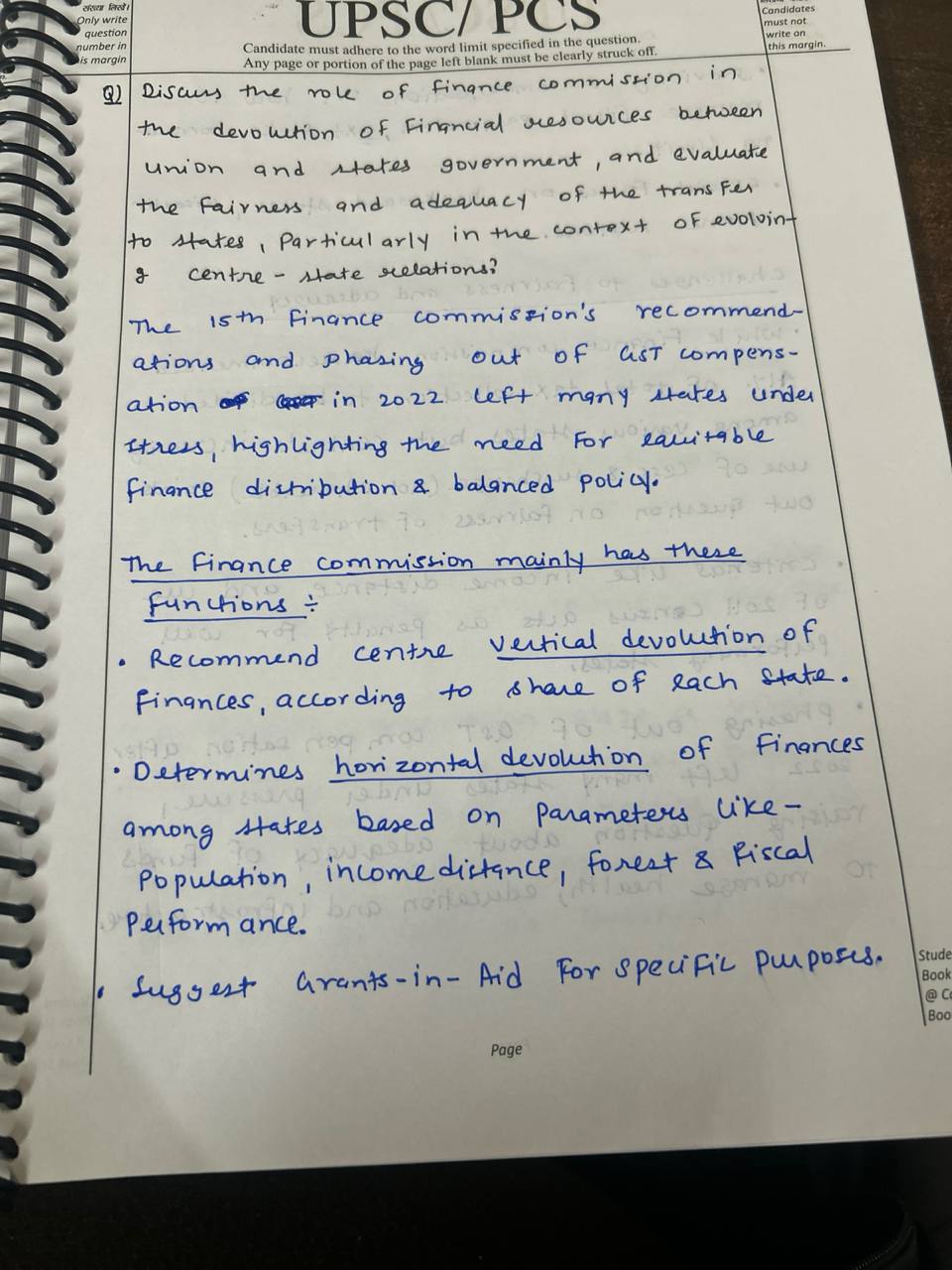

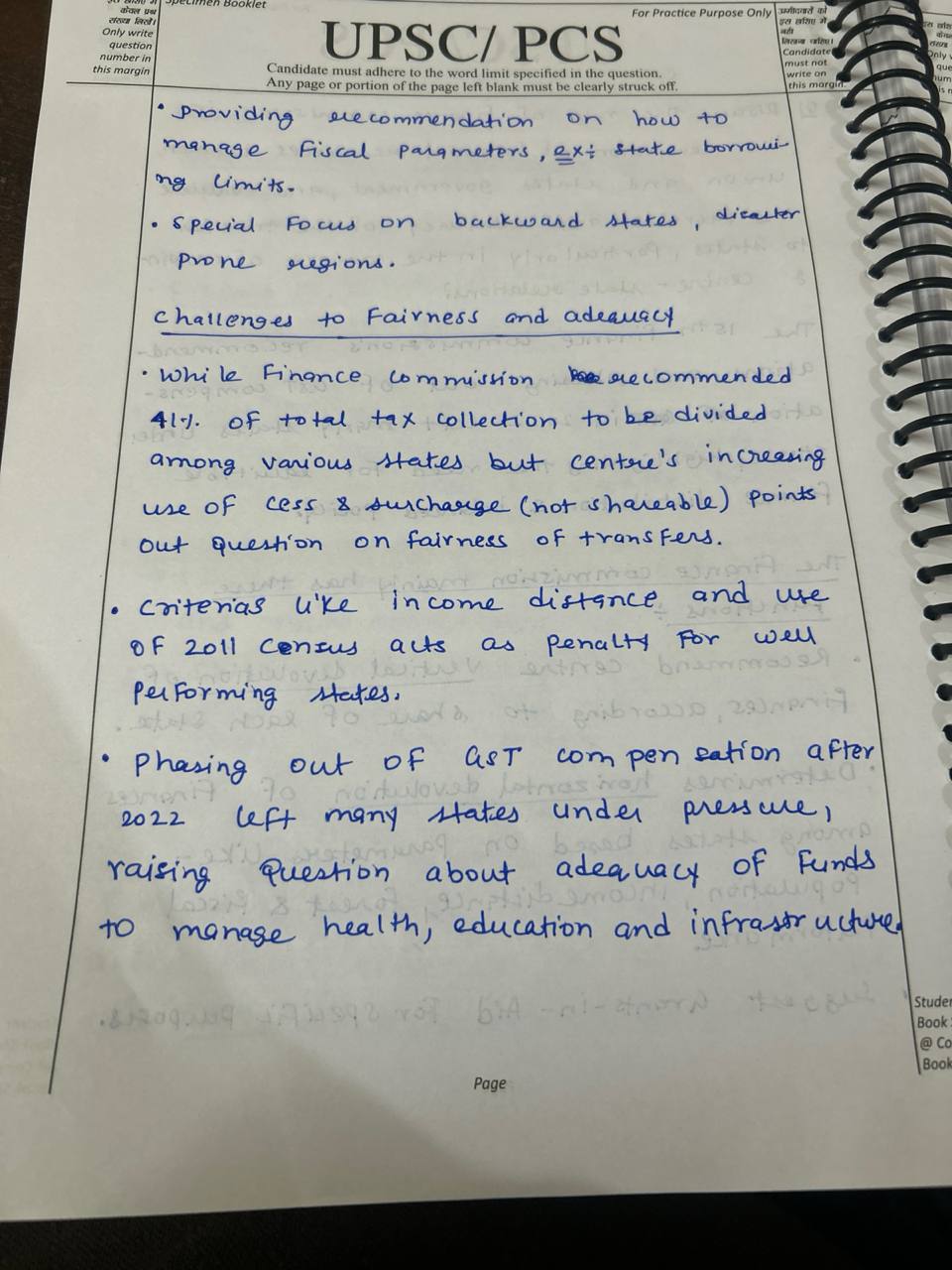

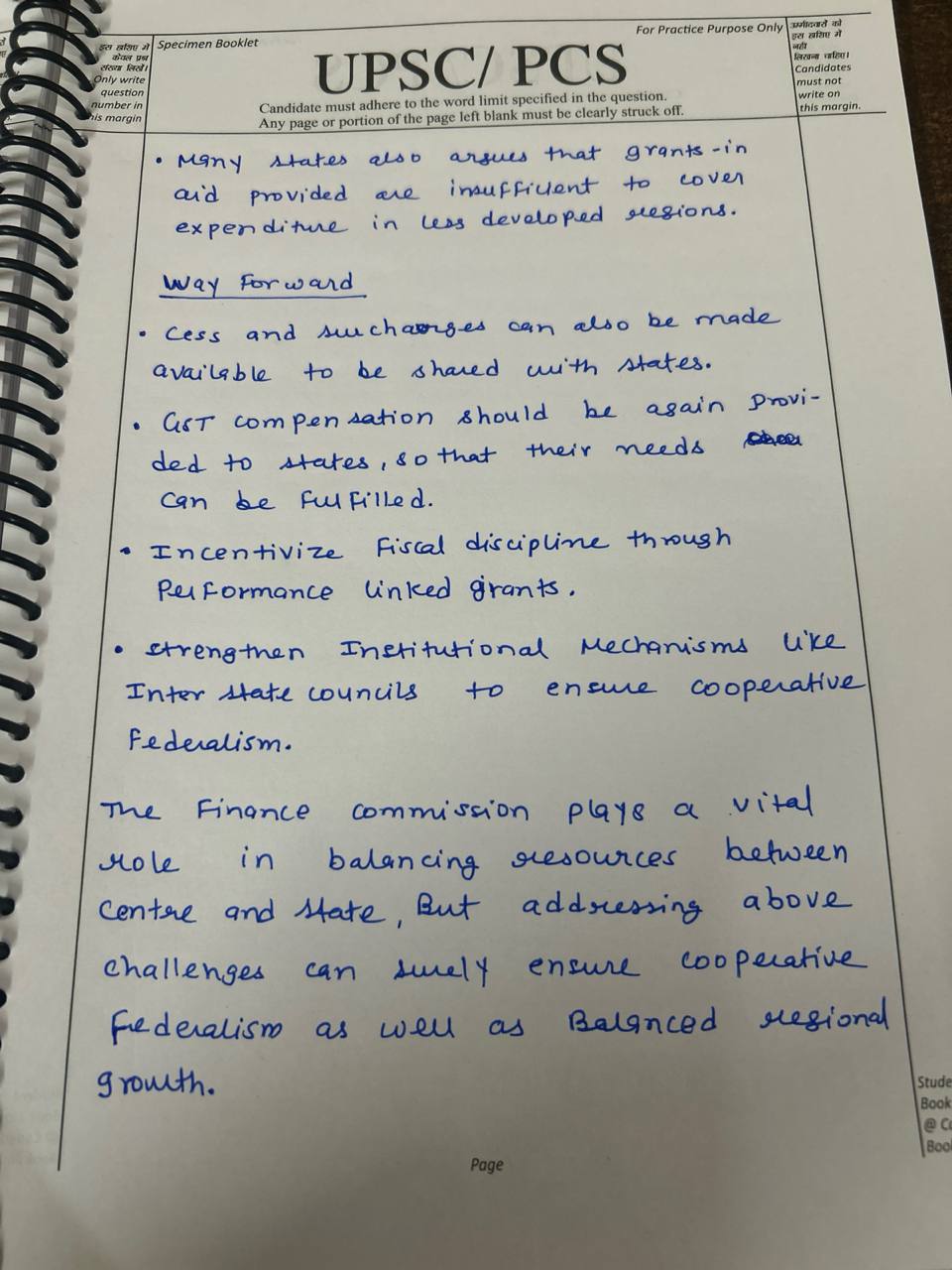

Examine the fairness and sufficiency of the transfers to the states, especially in light of the changing center-state fiscal relations, and discuss the role played by the Finance Commission in the devolution of financial resources between the Union and state ...

Describe what gender budgeting is. What relevance does this idea have in India? Has the government made any efforts to put this idea into effect?

-

Gender Budgeting refers to integrating gender perspective in preparation, analysis and assessment of budgets and policies and translating gender commitments into budgetary operations. It is put into use by embedding gender-specific goals in fiscal policies by emphasizing on reprioritization rather tRead more

Gender Budgeting refers to integrating gender perspective in preparation, analysis and assessment of budgets and policies and translating gender commitments into budgetary operations. It is put into use by embedding gender-specific goals in fiscal policies by emphasizing on reprioritization rather than an increase in overall public expenditure or creation of a separate budget. It aims to achieve gender mainstreaming in legislation, policies and programmes to ensure that benefits and development reach women.

Significance of gender budgeting in India:

- It increases transparency and accountability of the budgeting process, as it highlights the proportional expenditure on both genders and the method/process of the expenditure.

- It will help in achieving SDG-5, related to achieving gender equality and empowering all women and girls.

- Special attention would address female’s vulnerabilities and provide them access to resources and improve their performance on social indicators like health, education etc.

- Conscious efforts to create economic opportunities for women can help increase the female workforce participation rate, which remains low and consequently boost GDP.

- Integrating gender perspective into macroeconomic policy improves equity of the overall budget process.

The Centre and states have taken various steps to adopt gender budgeting, such as:

- The first significant attempt at making gender-sensitive resource allocation was the “Women’s Component Plan” (WCP) as a part of the Ninth Five-Year Plan (1997-2002), which earmarked 30% of developmental funds for women under various schemes of ministries/departments.

- India adopted the WCP as a budgetary strategy in 2004-05 and since then it has been institutionalized in the annual budget by incorporating the gender budget statement. This statement highlights the annual budget allocation for welfare schemes for women by categorizing them as “Women-Specific Schemes” (100% fund allocation for women) and “Pro- Women Schemes” (where at least 30% of the allocation is for women).

- A Gender Budgeting Secretariat has been placed in the Ministry of Finance, and central ministries and departments have been mandated to set up gender budgeting cells to initiate and take forward the gender budgetary strategy.

- The Ministry of Women and Child Development has come up with guidelines for integrating gender budgeting into beneficiary-oriented schemes.

- Many states and union territories such as Rajasthan, Gujarat, Karnataka, Kerala, Andaman and Nicobar islands, Dadra and Nagar Haveli etc. have taken significant steps to institutionalise gender budgeting.

Apart from these, there is a need to significantly increase the budgetary allocation for women, as funds allocated for Gender Responsive Budgeting are approximately 5% of the public expenditure and less than 1% of GDP. Further, careful analysis of gender-oriented schemes before launching and post implementation would go a long way in curbing gender inequalities and contributing to the overall development.

See less

What role does national income accounting play? Talk about the numerous elements that influence a nation’s GDP. (Answer in 200 words)

-

This answer was edited.

Consider the impact on the quality and efficiency of public spending of the government’s attempts to rationalize and prioritize public expenditure, such as the implementation of zero-based budgeting, the identification of subsidies and other inefficient spending, and the distribution of ...

-

Evaluation of Government Efforts to Rationalize and Prioritize Public Expenditure Rationalizing and prioritizing public expenditure is crucial for improving the quality and efficiency of public spending. The Indian government has undertaken several initiatives in this regard, including the adoptionRead more

Evaluation of Government Efforts to Rationalize and Prioritize Public Expenditure

Rationalizing and prioritizing public expenditure is crucial for improving the quality and efficiency of public spending. The Indian government has undertaken several initiatives in this regard, including the adoption of zero-based budgeting (ZBB), identification of subsidies and inefficient expenditures, and reallocation of resources to high-impact social and infrastructure projects. This analysis evaluates these efforts and their impact on public expenditure management.

1. Zero-Based Budgeting (ZBB)

- Objective and Scope: Zero-based budgeting involves starting the budgeting process from scratch each year, rather than basing it on the previous year’s budget. This approach requires justifying every expense and allocating resources based on current needs and priorities.

- Recent Developments: The Indian government has progressively implemented ZBB to enhance transparency and efficiency in public spending. For example, the Ministry of Defence adopted ZBB for its budget in 2023, aiming to optimize expenditure on defense procurement and operational needs.

- Impact on Efficiency: ZBB helps in identifying redundant or low-priority expenditures, ensuring that resources are allocated based on strategic goals rather than historical allocations. This has led to more targeted spending and better alignment with current policy objectives.

- Recent Example: In 2024, the Ministry of Health and Family Welfare introduced ZBB for its health schemes, leading to a more efficient allocation of funds towards critical health interventions, such as vaccination programs and healthcare infrastructure development.

2. Identification and Rationalization of Subsidies

- Objective and Scope: The government has focused on identifying and rationalizing subsidies to eliminate inefficiencies and ensure that subsidies reach the intended beneficiaries. This involves scrutinizing existing subsidies and redirecting funds to high-impact areas.

- Recent Developments: The Direct Benefit Transfer (DBT) system has been instrumental in targeting subsidies more effectively. By linking subsidies to Aadhaar numbers and bank accounts, the government has reduced leakage and ensured better delivery of benefits.

- Impact on Efficiency: Rationalizing subsidies has improved the efficiency of public spending by reducing wastage and ensuring that support reaches vulnerable groups. For instance, the subsidy on cooking gas under the Pradhan Mantri Ujjwala Yojana (PMUY) has been streamlined to prevent misuse and ensure that it benefits deserving households.

- Recent Example: In 2024, the government restructured the Food Subsidy Scheme, focusing on direct transfers to beneficiaries and improving the efficiency of food distribution through technology-enabled monitoring.

3. Allocation of Resources to High-Impact Social and Infrastructure Projects

- Objective and Scope: Prioritizing high-impact social and infrastructure projects ensures that public expenditure drives substantial benefits for economic growth and social development. This involves focusing on projects with significant potential for improving quality of life and supporting sustainable development.

- Recent Developments: The government has allocated substantial resources to flagship programs like the Jal Jeevan Mission for rural water supply, the Pradhan Mantri Awas Yojana (PMAY) for affordable housing, and the National Infrastructure Pipeline (NIP), which targets investment in critical infrastructure.

- Impact on Quality of Spending: Prioritizing high-impact projects improves the overall effectiveness of public expenditure by addressing critical needs and fostering long-term development. For example, the Jal Jeevan Mission has significantly improved access to clean drinking water in rural areas, enhancing public health and quality of life.

- Recent Example: In 2024, the government launched the National Green Hydrogen Mission, focusing on investing in green energy infrastructure. This initiative is expected to drive sustainable development and create long-term economic and environmental benefits.

4. Overall Impact on Quality and Efficiency of Public Spending

- Improved Resource Allocation: Efforts to rationalize and prioritize public expenditure have led to more effective allocation of resources. By focusing on high-impact projects and using ZBB, the government has enhanced the efficiency of spending and ensured that funds are directed towards areas with the greatest need.

- Increased Transparency and Accountability: Initiatives like ZBB and DBT have improved transparency and accountability in public spending. These measures help in tracking expenditure more accurately and ensuring that resources are used effectively.

- Challenges and Areas for Improvement: Despite progress, challenges remain in fully implementing these strategies. Issues such as bureaucratic inertia, resistance to change, and coordination between different levels of government can affect the effectiveness of these efforts. Continuous monitoring, capacity building, and process improvements are essential to addressing these challenges.

Conclusion

The Indian government’s efforts to rationalize and prioritize public expenditure, through measures like zero-based budgeting, subsidy rationalization, and targeted investment in high-impact projects, have significantly improved the quality and efficiency of public spending. These initiatives have enhanced resource allocation, increased transparency, and contributed to better outcomes in social and infrastructure development. Ongoing efforts to address implementation challenges and refine these strategies will be crucial for sustaining and further enhancing the effectiveness of public expenditure.

See less

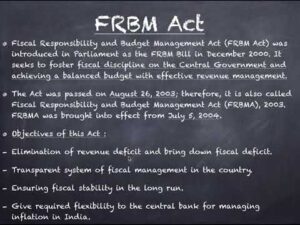

What goals does the Fiscal Responsibility and Budget Management Act of 2003 (FRBMA) seek to achieve? List the salient qualities of it. (Answer in 200 words)

-

This answer was edited.

The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA):- This act aims to bring the discipline in the government's finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public) The Objectives of the (FRBMA) ACT,2003 are as follows : ItRead more

The Fiscal Responsibility and Budget Management Act, 2003

(FRBMA):-

(FRBMA):-This act aims to bring the discipline in the government’s finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public)

The Objectives of the (FRBMA) ACT,2003 are as follows :

- It reduces the Fiscal deficit: It sets targets to gradually bring down the government budget deficit. This aims for the more balanced budget.

- It eliminates a Revenue Deficit: This Act also targets on the elimination of the revenue deficit, where government spending exceeds its income. This act ensures that the Government should not rely on the borrowings to meets its expenses.

- It enhances the fiscal transparency: This act Promotes the transparency among the public by disclosing their fiscal targets and achievements. This enhances the public trust.

- It ensures debt sustainability: This Act, enables the limit on the total liabilities as a percentage of GDP (Gross Domestic Product) for the government. This act secures the upcoming generations from the excessive burden of the debt.

- It promotes macroeconomic stability: By achieving the above objectives, this act fosters to create more stable and growing economy of a country.

Functions of (FRBMA) ACT, 2003 are as follows :

- Reduce Fiscal Deficit: This act lay out specific targets for reducing Fiscal and Revenue deficit over a medium-term period. The targets are reviewed and examined periodically.

- Medium-Term Fiscal Policy statement: The government is obligated to present a medium-term fiscal policy statements which outlines it’s fiscal strategy and future projections.

- Escape cause: It sometimes allows the deviations from the targets only during the exceptional cases like natural disasters or economy downfall.

- fiscal council: An independent Fiscal Council es initially formed by this act to monitor the government’s loyalty to the targets formed by FRBMA (Fiscal Responsibility and Budget management Act.)

I am enclosing an image which describes this matter in a more significant manner and the language used is too easy to understand.

See less

Examine how the government is using cutting-edge financing tools like crowdfunding, social impact bonds, and green bonds to raise more money for social welfare and development projects. Also, consider how these tools might be used to supplement more conventional budgetary ...

-

Government Strategies to Leverage Innovative Financing Mechanisms Innovative financing mechanisms, such as green bonds, social impact bonds, and crowdfunding, have emerged as pivotal tools for mobilizing additional resources for development projects and social welfare programs. These mechanisms offeRead more

Government Strategies to Leverage Innovative Financing Mechanisms

Innovative financing mechanisms, such as green bonds, social impact bonds, and crowdfunding, have emerged as pivotal tools for mobilizing additional resources for development projects and social welfare programs. These mechanisms offer potential to complement traditional budgetary resources and enhance the effectiveness of development initiatives.

1. Green Bonds

Definition and Purpose: Green bonds are debt instruments issued to raise funds specifically for projects with environmental benefits. The proceeds are used for projects that address climate change, reduce carbon emissions, or improve environmental sustainability.

Recent Examples:

- India’s Green Bonds Market: In 2023, India witnessed significant growth in its green bonds market, with the issuance of green bonds by organizations like the National Bank for Agriculture and Rural Development (NABARD). These bonds fund renewable energy projects and sustainable infrastructure development.

- International Example: The European Union issued green bonds as part of its Green Deal, aiming to finance projects related to renewable energy, sustainable agriculture, and pollution reduction.

Impact and Potential: Green bonds attract investment from both domestic and international markets, providing a substantial pool of funds for environmental projects. They complement traditional funding by tapping into a niche market of investors interested in sustainable development, thus bolstering the budgetary resources allocated to environmental sustainability.

2. Social Impact Bonds (SIBs)

Definition and Purpose: Social impact bonds are a type of contract where private investors provide upfront capital for social programs and are repaid by the government only if the programs achieve predefined social outcomes. They are designed to improve social outcomes while shifting the financial risk away from public funds.

Recent Examples:

- India’s Early Childhood Development Program: In 2023, India launched its first Social Impact Bond to fund early childhood development programs. The bond involves private investors who will be repaid based on the improvement in child health and education indicators.

- International Example: The UK has implemented SIBs for programs addressing recidivism rates among ex-offenders, where private investors fund rehabilitation programs and receive returns based on successful outcomes.

Impact and Potential: SIBs align financial incentives with social outcomes, encouraging innovation and efficiency in service delivery. They provide a mechanism to address social issues without upfront public expenditure, thereby complementing traditional budgetary resources and fostering public-private partnerships.

3. Crowdfunding

Definition and Purpose: Crowdfunding involves raising small amounts of money from a large number of people, typically via online platforms, to fund development projects or social initiatives. It democratizes the funding process and allows direct participation from the public.

Recent Examples:

- India’s Crowdfunding for Education: In 2023, several educational NGOs used crowdfunding platforms to raise funds for rural education projects, including the construction of schools and distribution of learning materials.

- International Example: In the United States, platforms like GoFundMe have been used to fund community-driven projects and social welfare initiatives, such as disaster relief and local health services.

Impact and Potential: Crowdfunding harnesses public engagement and broadens the resource base beyond traditional institutional funding. It allows for community-driven initiatives and can complement traditional resources by providing additional capital and raising awareness about various causes.

Evaluation of Complementary Potential

Advantages:

- Diversification of Funding Sources: Innovative financing mechanisms diversify funding sources, reducing reliance on traditional budgetary allocations and increasing financial resilience.

- Increased Efficiency and Innovation: Mechanisms like SIBs and green bonds encourage efficient and innovative approaches to project implementation, driven by performance-based outcomes.

- Enhanced Public Participation: Crowdfunding enables greater public engagement and support for development projects, fostering a sense of ownership and community involvement.

Challenges:

- Risk and Uncertainty: Innovative financing mechanisms carry risks, including market volatility for green bonds and uncertain returns on SIBs, which can impact the stability of funding.

- Implementation Complexity: The structuring and management of these mechanisms require expertise and can be complex, potentially leading to administrative challenges.

In conclusion, innovative financing mechanisms offer valuable opportunities to complement traditional budgetary resources by providing additional funding, enhancing efficiency, and fostering public engagement. Their successful integration into development strategies can lead to more sustainable and impactful outcomes for social welfare programs and infrastructure projects.

See less

Inadequacies in public spending have been brought to light repeatedly in audit reports concerning different development efforts in India. After identifying these inefficiencies, make recommendations for possible solutions. (Answer in 150 words)

-

Effective use of financial resources has been highlighted in the United Nations Sustainable Development Group (UNDG) Reference Guide as a critical dimension in the achievement of Sustainable Development Goals (SDGs). Further, in the SDG India Index, NITI Aayog has also recognised that financial resoRead more

Effective use of financial resources has been highlighted in the United Nations Sustainable Development Group (UNDG) Reference Guide as a critical dimension in the achievement of Sustainable Development Goals (SDGs). Further, in the SDG India Index, NITI Aayog has also recognised that financial resources are a fundamental driver for achieving the SDGs on time. However, audit reports on various development initiatives and the finances of the Center and states have frequently highlighted inefficacies in expenditure.

These include:

- Persistent non-spending of allocated funds: The persistent problem of unspent balances is a direct consequence of India’s broken governance structures (at various levels), which have been highlighted in various reports. For instance, a CAG report on the Clean Ganga Mission pointed to an unspent balance of approximately Rs. 2500 crores in 2017.

- Diversion and parking of funds: The CAG report of 2017 on performance audit of disaster management in Jammu and Kashmir reported that 25 percent of the expenditure meant for disaster mitigation purposes was diverted towards ineligible works.

- Irregular and wasteful expenditure: The CAG report in 2020 exposed several irregularities and wasteful expenditures to the tune of hundreds of crores by various Goa government departments.

- Misallocation/misutilisation of funds: Welfare schemes such as the Sarva Shiksha Abhiyan, Mid-Day Meal Scheme, PM Awas Yojana, Swachh Bharat Mission, etc. are riddled with misallocation and leakages. A Parliamentary Standing Committee report highlighted the issues of widespread corruption, insufficient funding and huge pending payments for wages in schemes like the MGNREGA.

The Voluntary National Review (VNR) Report and Three Year Action Agenda have listed out several measures for improving expenditure efficiency and effectiveness, which are as follows:

- Reorientation of the Budget with SDGs: Preparation of the Outcome Budget mandated since 2006-07 has not been as effective as envisaged and there is a need to reorient the Budget with SDGs. States like Haryana, Maharashtra, Assam etc. have taken some preliminary steps in this regard.

- Expenditure reforms: These include the following:

- Introduction of sunset clauses in all public expenditure programmes.

- Effective utilisation of the Public Financial Management System for tracking all expenditure flows.

- Rationalisation of schemes through merger and dropping of overlapping schemes.

- Use of technology like e-procurement and adoption of a Government e-Marketplace (GeM) model etc.

- Intervention at the stage of formulation of schemes: The schemes need to be formulated after adequate consultation with the state governments. There should be specific Ministry-wise Councils so that the Ministries formulate schemes in tandem with the existing state schemes for optimum utilization of resources.

- Need of an expert institution: The NITI Aayog or a body like the Centre-State Expenditure Commission can give directives and lay down the priorities with respect to expenditure.

In addition, improving efficiency of expenditure would need to be established through suitable audits. Further, a decentralized and local approach can help in achieving efficiency while incurring expenditure.

See less

Three functions are included in the Indian government budget: allocation, redistribution, and economic stabilization. Talk about it.

-

The Indian government's budget serves three primary functions in the economy: allocation, redistribution, and stabilization. Let's discuss each of these functions in detail: Allocation Function: The allocation function of the government's budget involves the distribution of resources and expenditureRead more

The Indian government’s budget serves three primary functions in the economy: allocation, redistribution, and stabilization. Let’s discuss each of these functions in detail:

- Allocation Function:

- The allocation function of the government’s budget involves the distribution of resources and expenditure across different sectors and activities.

- This includes investments in public goods and services, such as infrastructure, education, healthcare, and social welfare programs.

- The government uses the budget to direct resources towards areas that are vital for the country’s economic and social development, but may not be adequately addressed by the private sector.

- Redistribution Function:

- The redistribution function of the government’s budget aims to reduce income and wealth inequality in the economy.

- This is achieved through progressive taxation, where individuals and businesses with higher incomes or wealth pay a higher proportion of their income as taxes.

- The government then uses the collected tax revenue to fund social welfare programs, subsidies, and targeted interventions that benefit the lower-income and marginalized sections of the population.

- The goal is to ensure a more equitable distribution of resources and improve the overall standard of living.

- Stabilization Function:

- The stabilization function of the government’s budget is aimed at maintaining macroeconomic stability and promoting economic growth.

- During times of economic downturns or recessions, the government can use expansionary fiscal policies, such as increased government spending or tax cuts, to stimulate the economy and support employment and consumer demand.

- Conversely, during periods of high inflation or economic overheating, the government can adopt contractionary fiscal policies, such as reducing government spending or increasing taxes, to cool the economy and maintain price stability.

- The stabilization function helps the government to manage the business cycle and mitigate the adverse effects of economic fluctuations.

In the context of the Indian economy, the government’s budget plays a crucial role in addressing these three functions. The allocation function is evident in the prioritization of investments in areas like infrastructure, education, and healthcare, which are essential for the country’s long-term development

See less - Allocation Function:

Roadmap for Answer Writing 1. Introduction Define Women Empowerment: Briefly explain what women empowerment entails and its significance in India. Introduce Gender Budgeting: Explain the concept of gender budgeting and its relevance to women empowerment. 2. Requirements for Effective Gender Budgeting A. Capacity Building for ...

-

Model Answer Introduction Women empowerment in India is a critical issue, as gender disparities persist in education, health, employment, and political participation. Gender budgeting, a fiscal tool aimed at promoting gender equality, has emerged as a solution to bridge these gaps. It ensures that gRead more

Model Answer

Introduction

Women empowerment in India is a critical issue, as gender disparities persist in education, health, employment, and political participation. Gender budgeting, a fiscal tool aimed at promoting gender equality, has emerged as a solution to bridge these gaps. It ensures that government budgets respond to the different needs of women and men by allocating resources specifically for programs that benefit women.

Requirements of Gender Budgeting

-

Gender Analysis of Expenditure and Revenue: Governments must assess how public funds impact women and men differently, ensuring that budget allocations address the specific needs of women.

-

Dedicated Schemes and Fund Allocations: Gender budgeting requires the establishment of specific schemes aimed at improving women’s socio-economic status, such as in education, health, and employment.

-

Institutional Mechanisms: An effective gender budgeting process involves setting up dedicated institutional frameworks like gender cells within government departments to monitor and evaluate gender-related programs.

-

Capacity Building: Training government officials in gender analysis and sensitizing policymakers to the need for gender-responsive budgeting is essential.

-

Data Collection: Accurate data on gender-specific outcomes is necessary for effective monitoring and evaluation of the impact of budgetary allocations on women’s welfare.

Status of Gender Budgeting in India

India adopted gender budgeting in 2005-06, and since then, various ministries have integrated gender perspectives into their budgetary processes. However, the progress is mixed:

- In 2021-22, the Gender Budget constituted only 4.4% of the total Union Budget (Source: Ministry of Finance).

- Several flagship schemes like Beti Bachao Beti Padhao and Pradhan Mantri Matru Vandana Yojana focus on women’s empowerment. However, the National Institute of Public Finance and Policy (NIPFP) found that many schemes lack proper monitoring mechanisms.

- Only a few states, such as Kerala and Bihar, have made notable progress in implementing gender budgeting at the local level.

Conclusion

While India has made strides in incorporating gender budgeting, its impact is hindered by inadequate implementation, lack of accountability, and insufficient focus on addressing systemic gender issues. To truly empower women, there must be stronger institutional mechanisms and targeted interventions backed by gender-disaggregated data and transparent monitoring.

See less -

Direct tax is a type of tax where the incidence and impact of taxation fall on the same entity. In the case of direct tax, the burden cannot be shifted by the taxpayer to someone else. Income tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax. Indirect tax isRead more

Direct tax is a type of tax where the incidence and impact of taxation fall on the same entity. In the case of direct tax, the burden cannot be shifted by the taxpayer to someone else. Income tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax. Indirect tax is a levy where the incidence and impact of taxation do not fall on the same entity. The burden of tax can be shifted by the taxpayer to someone else. It is usually imposed on a manufacturer or supplier who then passes on the tax to the consumer. It is imposed on a product or service. Indirect tax has the effect of raising prices of products on which they are imposed. Goods and Services Tax (GST), customs duty etc. are examples of indirect taxes. Direct taxes are considered progressive because the government can impose a lower tax rate on low-income earners compared to those with a higher income. That means in direct taxes, it is possible to impose higher taxation rates for the rich and lower tax rate for the poor. It reduces the tax burden on people who can least afford to pay them and takes a larger percentage from high- income earners. For example, personal income tax in India has a higher tax rate for higher income slab. Indirect taxes are considered regressive in nature as they are applied uniformly to all taxpayers, regardless of their income level. For example, same rate of taxation is applied in case of GST, an indirect tax, on the same amount of goods or services purchased. If two individuals buy the same amount (say a packet of biscuits), both have to pay the same amount of tax. The GST, in effect, constitutes a higher percentage of the lower-earning individual’s wages and a lower percentage of the higher-earning individual’s wages. In this way, direct taxes facilitate higher burden of taxes on the rich acting as a tool of redistributive justice while indirect taxes affect the poor more. Therefore, increasing the indirect taxes is considered as a regressive step while imposing direct taxes as per income level of the taxpayer is considered as progressive tax.

See less