What does the term “public debt” mean to you? Why is a high level of national debt seen as concerning? Talk about it in relation to India. (Answer in 200 words)

Goods and Services Tax (GST) is an indirect tax that came into effect on 1st July 2017 by replacing many indirect taxes in India such as the excise duty, VAT, services tax, etc. Goods and Service Tax (GST) is levied on the supply of goods and services and is a destination-based tax that is levied onRead more

Goods and Services Tax (GST) is an indirect tax that came into effect on 1st July 2017 by replacing many indirect taxes in India such as the excise duty, VAT, services tax, etc. Goods and Service Tax (GST) is levied on the supply of goods and services and is a destination-based tax that is levied on every value addition.

Salient features of the Goods and Services Tax:

- GST is applicable on the ‘supply’ of goods or services as against the concept of the manufacture of goods or on sale of goods or provision of services.

- GST is based on the principle of destination-based consumption taxation as against the principle of origin-based taxation.

- India has a dual GST system with the Centre and the States simultaneously levying tax on a common base. The GST to be levied by the Centre is the Central GST(CGST) and that to be levied by the States is the State GST (SGST).

- An Integrated GST (IGST) is levied on the inter-state supply of goods or services. This is levied and collected by the Government of India and such tax is apportioned between the Union and the States in the manner as may be provided by Parliament by law on the recommendation of the GST Council.

- Import of goods or services would be treated as inter-state supplies and would be subject to IGST in addition to the applicable customs duties.

Since its implementation in 2017, the GST has achieved the following milestones:

- Widening of India’s tax base: The tax base almost doubled from 66.25 lakhs to 1.28 crores in the last four years (2017-2021).

- Ease of compliance: It brought inefficiencies in indirect tax compliances and reduced the number of indirect tax authorities that businesses needed to interact with.

- Increased logistics efficiency: As per an estimate, it has saved over 50% of logistics effort and transit time of goods movement by eliminating the entry tax, and check-posts (inter-state barriers) and introducing nationwide e-way bills.

- Reduced transaction costs: By eliminating 2% of the additional cost (Central Sales Tax) on all interstate transactions, the GST has significantly reduced the overall transaction cost.

- Increase in transparency: It allows taxpayers to track their compliances online on the GST Portal, and get the basic information about any business by entering the respective PAN or GSTIN, etc, thus increasing transparency in the system.

However, several challenges still need to be addressed, such as:

- Overestimation of GST collection: Actual collection is lower than initial estimations, thereby raising questions on the efficacy of the GST regime.

- Complex tax slabs: A complex slab structure with frequent switching of items between them leads to confusion in the compliance system and unethical profiteering due to fluctuating tax rates.

- Complex and cumbersome filing structure: The current GST return filing structure puts the onus of burden on the taxpayer with requirements of possessing a valid tax invoice/debit note, actual receipt of goods/service by the recipient, etc., making it a complex and cumbersome tax regime.

- Ambiguous and conflicting AAR judgments: Conflicting rulings from various benches of the Appellate Authority for Advance Ruling across different States have led to confusion among taxpayers.

- Tax evasion and tax fraud: GST tax evasion and tax fraud, including the use of fraudulent invoices, fake e-way bills, etc have led to massive losses in revenue collection (approximately Rs. 40,000 crore).

While the government has worked to solve many issues, considerable intervention is still required to bring GST to its full efficiency. The proposal to have a single return will simplify compliance and do away with matching requirements. Such a step will bring out the true sense of ‘One Nation, One Tax’.

See less

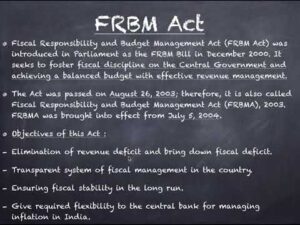

(FRBMA):-

(FRBMA):-

Public debt, also known as government debt or national debt, refers to the total amount of money owed by a country's government to its citizens, businesses, and foreign investors. It is a cumulative result of budget deficits, borrowing for various purposes, and interest payments. High public debt isRead more

Public debt, also known as government debt or national debt, refers to the total amount of money owed by a country’s government to its citizens, businesses, and foreign investors. It is a cumulative result of budget deficits, borrowing for various purposes, and interest payments.

High public debt is a matter of concern for several reasons:

1. Burden on future generations: High debt may lead to increased taxation and reduced government spending on essential services, affecting future generations.

2. Inflation: Excessive borrowing can lead to inflation, reducing the purchasing power of citizens.

3. Reduced credit rating: High debt may lower a country’s credit rating, increasing borrowing costs and reducing investor confidence.

4. Reduced fiscal space: High debt limits a government’s ability to respond to economic downturns or fund development projects.

In the context of India, high public debt is a concern due to:

– Rising debt to GDP ratio (currently over 90%)

– Large fiscal deficits

– Increasing reliance on market borrowing

– Pressure on interest payments (around 50% of tax revenue)

– Limited fiscal space for development spending

To address these concerns, India needs to focus on fiscal consolidation, improve tax compliance, and enhance economic growth through structural reforms.

See less