Three functions are included in the Indian government budget: allocation, redistribution, and economic stabilization. Talk about it.

- Recent Questions

- Most Answered

- Answers

- No Answers

- Most Visited

- Most Voted

- Random

- Bump Question

- New Questions

- Sticky Questions

- Polls

- Followed Questions

- Favorite Questions

- Recent Questions With Time

- Most Answered With Time

- Answers With Time

- No Answers With Time

- Most Visited With Time

- Most Voted With Time

- Random With Time

- Bump Question With Time

- New Questions With Time

- Sticky Questions With Time

- Polls With Time

- Followed Questions With Time

- Favorite Questions With Time

Mains Answer Writing Latest Questions

What role does national income accounting play? Talk about the numerous elements that influence a nation’s GDP. (Answer in 200 words)

-

This answer was edited.

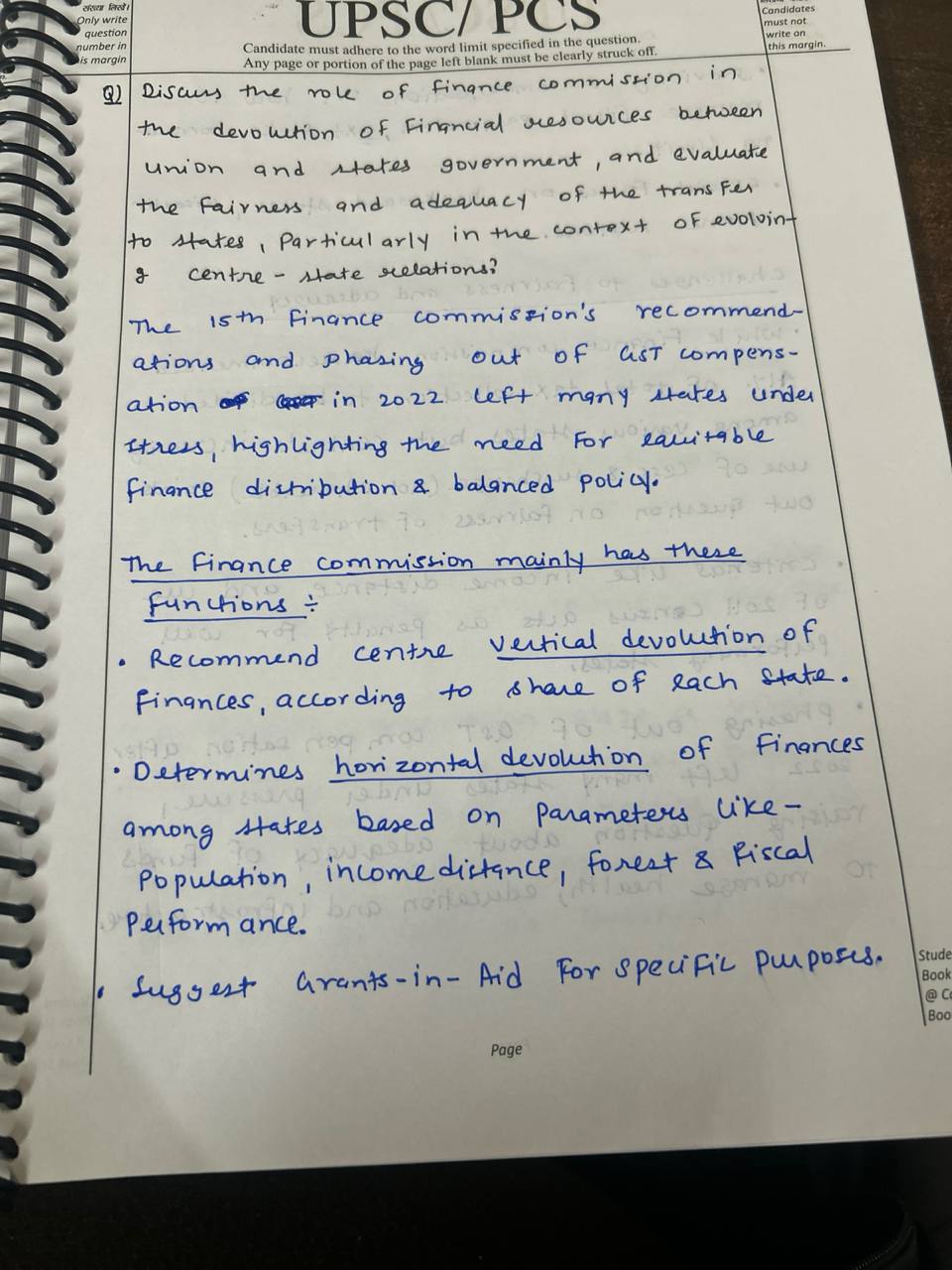

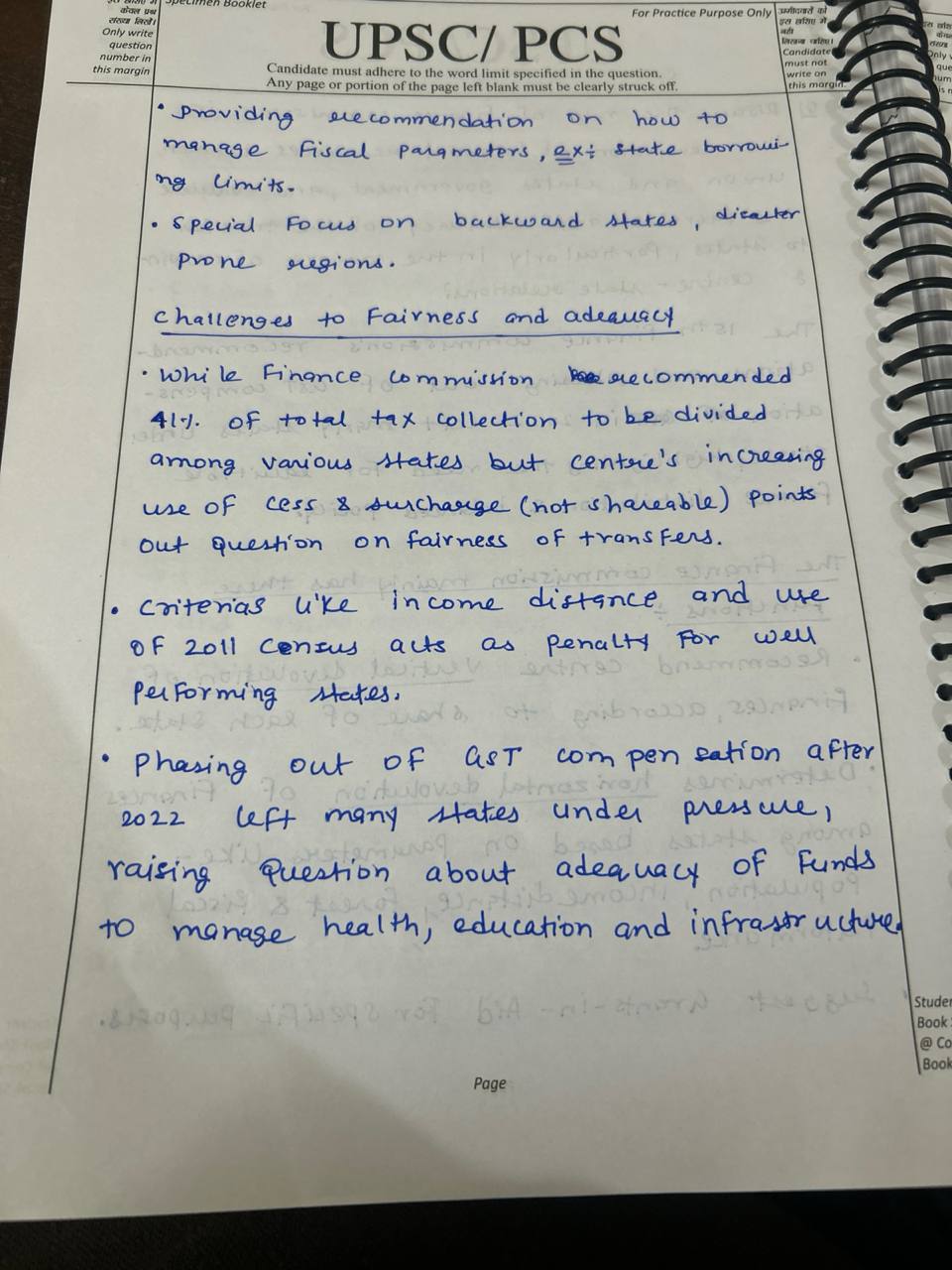

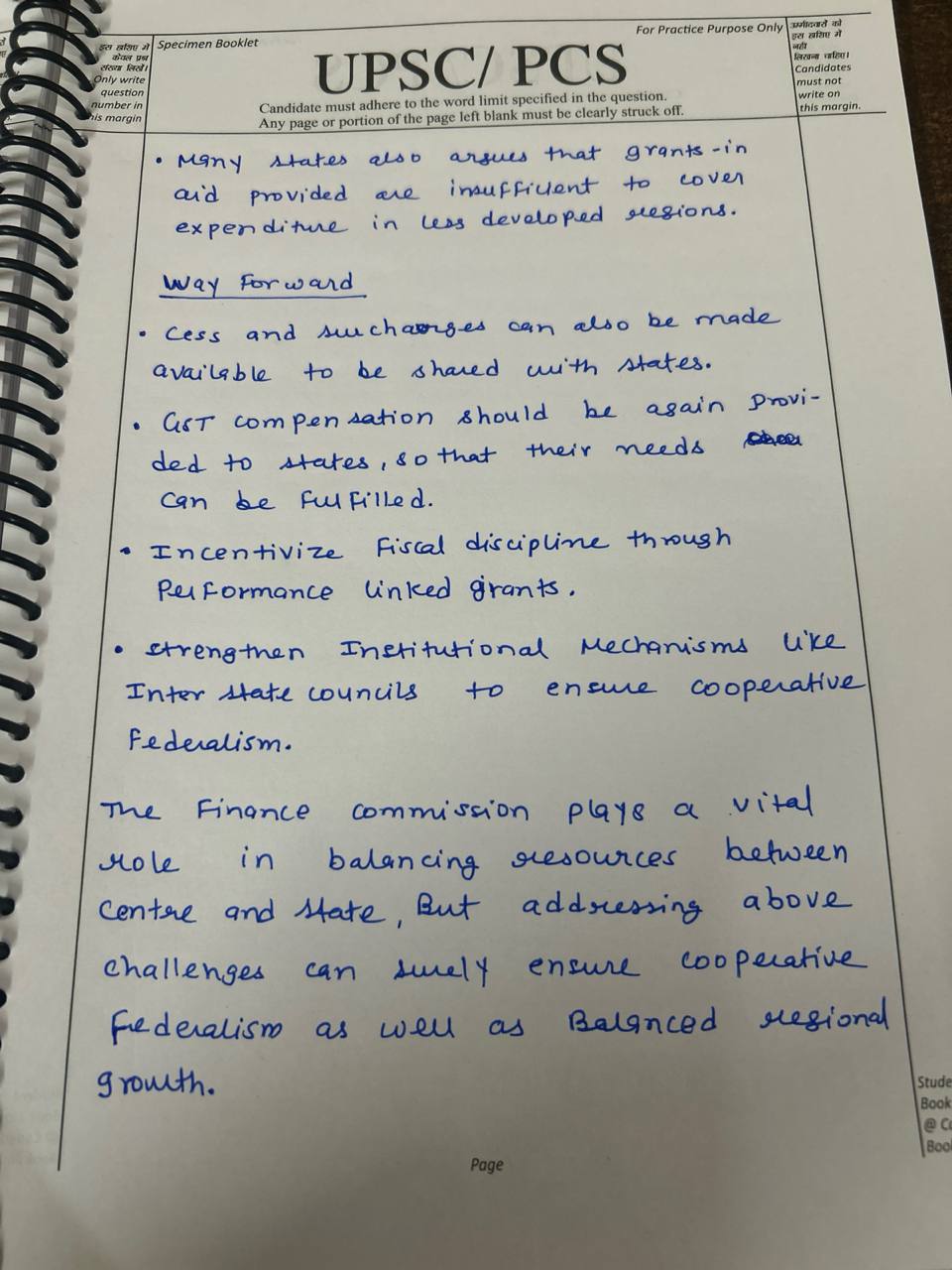

Examine the fairness and sufficiency of the transfers to the states, especially in light of the changing center-state fiscal relations, and discuss the role played by the Finance Commission in the devolution of financial resources between the Union and state ...

Roadmap for Answer Writing 1. Introduction Objective: Introduce the concept of public expenditure management (PEM) and its relevance in the context of budget-making. Definition: Explain PEM as the prudent use of government financial resources to achieve good governance, fiscal discipline, and macroeconomic stability. 2. ...

-

Model Answer Introduction Public expenditure management (PEM) refers to the efficient use of government financial resources to achieve good governance, encompassing fiscal discipline, resource allocation, operational efficiency, and macroeconomic stability. Since the liberalization, privatization, aRead more

Model Answer

Introduction

Public expenditure management (PEM) refers to the efficient use of government financial resources to achieve good governance, encompassing fiscal discipline, resource allocation, operational efficiency, and macroeconomic stability. Since the liberalization, privatization, and globalization (LPG) reforms of 1991, PEM has presented several challenges for the Government of India, particularly in the context of budget-making.

Challenges in Public Expenditure Management

1. Exposure to Global Economic Shocks

The integration of the Indian economy into the global market has made it vulnerable to external economic shocks, such as the 2008 global financial crisis, fluctuations in crude oil prices, and trade wars. These shocks significantly impact domestic budget estimates and economic stability.

2. Fiscal Policy Constraints

The government faces pressure to increase spending on infrastructure and welfare schemes while adhering to the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, which mandates keeping the fiscal deficit within 3% of GDP. Balancing these demands is a considerable challenge.

3. Banking Sector Challenges

Post-liberalization, the government has had to recapitalize public sector banks, which struggle to operate profitably while ensuring financial inclusion. This creates a burden on public finances.

4. Privatization and Disinvestment Pressures

With the private sector’s capabilities expanding, there is growing demand for the privatization of inefficient public sector enterprises (PSEs). The government must navigate this transition while maintaining public service delivery.

5. Narrow Tax Base

Despite rising incomes, the income tax base has not expanded proportionately, limiting the government’s ability to increase social spending. The growing subsidy burden exacerbates this issue, diverting funds from capital investments.

6. Inadequate Institutional Capacity

Many government schemes suffer from poor implementation, leading to underutilization of allocated budgets. This inefficiency results in cost overruns and ineffective resource allocation.

Conclusion

The post-liberalization period has seen increased per capita income and government expenditure; however, the tax-to-GDP ratio has not improved correspondingly. This disparity has rendered public expenditure management a significant challenge for the Indian government. The Bimal Jalan Committee has recommended rationalizing subsidies and sticking to a disciplined fiscal path to unlock the growth potential of the Indian economy. Effective PEM is crucial for sustainable economic development and governance.

See less

Roadmap for Answer Writing 1. Introduction (30-40 words) Briefly introduce the two taxes: Long-term Capital Gains Tax (LTCG) and Dividend Distribution Tax (DDT). Mention the context: Union Budget 2018-19 ...

-

Model Answer The Union Budget 2018-19 introduced notable changes to the taxation of capital gains and dividends, significantly impacting investors and the stock market. Reintroduction of LTCG Tax The government reinstated a 10% Long-term Capital Gains (LTCG) tax on profits exceeding ₹1 lakh from theRead more

Model Answer

The Union Budget 2018-19 introduced notable changes to the taxation of capital gains and dividends, significantly impacting investors and the stock market.

Reintroduction of LTCG Tax

- The government reinstated a 10% Long-term Capital Gains (LTCG) tax on profits exceeding ₹1 lakh from the sale of listed equity shares. This move aimed to broaden the tax base and ensure fairness, as the previous tax exemption created disparities between equities and other asset classes.

Introduction of DDT on Mutual Funds

- The budget also introduced a 10% tax on dividends distributed by equity-oriented mutual funds. This aimed to close loopholes that allowed tax-free income distribution and prevent tax evasion, particularly in dividend stripping practices.

Advantages of These Changes

-

- Broadened Tax Base: The government’s revenue potential increased by taxing equity gains and dividends, facilitating investments in infrastructure and development.

- Market Stability: LTCG encouraged long-term investments, reducing speculative trading and promoting market stability.

- Prevention of Tax Evasion: The DDT closed a loophole in mutual fund dividends, ensuring all dividend income is taxed, contributing to better compliance.

- Global Alignment: These reforms harmonized India’s tax regime with international standards, attracting foreign investments.

Source: Post-Budget Market Analyses 2018.

Disadvantages of These Changes

-

- Investor Sentiment: The stock market initially reacted negatively to these tax changes, with middle-class investors feeling the impact of reduced post-tax returns.

- Complex Compliance: Investors faced increased complexity in tax filings, leading to greater reliance on financial advisors.

- Impact on Dividend Policies: Companies began retaining profits rather than distributing them, impacting shareholders’ income.

Source: Financial Market Reports, 2018.

Conclusion

In conclusion, while the 2018-19 budget changes promoted equity and a broader tax base, they also led to market adjustments and increased compliance burdens. Policymakers must balance these effects to ensure sustainable financial growth.

See less

Roadmap for Answer Writing 1. Introduction Define Women Empowerment: Briefly explain what women empowerment entails and its significance in India. Introduce Gender Budgeting: Explain the concept of gender budgeting and its relevance to women empowerment. 2. Requirements for Effective Gender Budgeting A. Capacity Building for ...

-

Model Answer Introduction Women empowerment in India is a critical issue, as gender disparities persist in education, health, employment, and political participation. Gender budgeting, a fiscal tool aimed at promoting gender equality, has emerged as a solution to bridge these gaps. It ensures that gRead more

Model Answer

Introduction

Women empowerment in India is a critical issue, as gender disparities persist in education, health, employment, and political participation. Gender budgeting, a fiscal tool aimed at promoting gender equality, has emerged as a solution to bridge these gaps. It ensures that government budgets respond to the different needs of women and men by allocating resources specifically for programs that benefit women.

Requirements of Gender Budgeting

-

Gender Analysis of Expenditure and Revenue: Governments must assess how public funds impact women and men differently, ensuring that budget allocations address the specific needs of women.

-

Dedicated Schemes and Fund Allocations: Gender budgeting requires the establishment of specific schemes aimed at improving women’s socio-economic status, such as in education, health, and employment.

-

Institutional Mechanisms: An effective gender budgeting process involves setting up dedicated institutional frameworks like gender cells within government departments to monitor and evaluate gender-related programs.

-

Capacity Building: Training government officials in gender analysis and sensitizing policymakers to the need for gender-responsive budgeting is essential.

-

Data Collection: Accurate data on gender-specific outcomes is necessary for effective monitoring and evaluation of the impact of budgetary allocations on women’s welfare.

Status of Gender Budgeting in India

India adopted gender budgeting in 2005-06, and since then, various ministries have integrated gender perspectives into their budgetary processes. However, the progress is mixed:

- In 2021-22, the Gender Budget constituted only 4.4% of the total Union Budget (Source: Ministry of Finance).

- Several flagship schemes like Beti Bachao Beti Padhao and Pradhan Mantri Matru Vandana Yojana focus on women’s empowerment. However, the National Institute of Public Finance and Policy (NIPFP) found that many schemes lack proper monitoring mechanisms.

- Only a few states, such as Kerala and Bihar, have made notable progress in implementing gender budgeting at the local level.

Conclusion

While India has made strides in incorporating gender budgeting, its impact is hindered by inadequate implementation, lack of accountability, and insufficient focus on addressing systemic gender issues. To truly empower women, there must be stronger institutional mechanisms and targeted interventions backed by gender-disaggregated data and transparent monitoring.

See less -

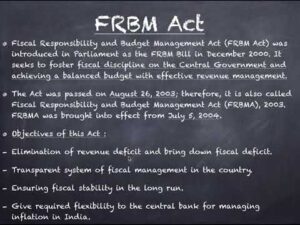

What goals does the Fiscal Responsibility and Budget Management Act of 2003 (FRBMA) seek to achieve? List the salient qualities of it. (Answer in 200 words)

-

This answer was edited.

The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA):- This act aims to bring the discipline in the government's finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public) The Objectives of the (FRBMA) ACT,2003 are as follows : ItRead more

The Fiscal Responsibility and Budget Management Act, 2003

(FRBMA):-

(FRBMA):-This act aims to bring the discipline in the government’s finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public)

The Objectives of the (FRBMA) ACT,2003 are as follows :

- It reduces the Fiscal deficit: It sets targets to gradually bring down the government budget deficit. This aims for the more balanced budget.

- It eliminates a Revenue Deficit: This Act also targets on the elimination of the revenue deficit, where government spending exceeds its income. This act ensures that the Government should not rely on the borrowings to meets its expenses.

- It enhances the fiscal transparency: This act Promotes the transparency among the public by disclosing their fiscal targets and achievements. This enhances the public trust.

- It ensures debt sustainability: This Act, enables the limit on the total liabilities as a percentage of GDP (Gross Domestic Product) for the government. This act secures the upcoming generations from the excessive burden of the debt.

- It promotes macroeconomic stability: By achieving the above objectives, this act fosters to create more stable and growing economy of a country.

Functions of (FRBMA) ACT, 2003 are as follows :

- Reduce Fiscal Deficit: This act lay out specific targets for reducing Fiscal and Revenue deficit over a medium-term period. The targets are reviewed and examined periodically.

- Medium-Term Fiscal Policy statement: The government is obligated to present a medium-term fiscal policy statements which outlines it’s fiscal strategy and future projections.

- Escape cause: It sometimes allows the deviations from the targets only during the exceptional cases like natural disasters or economy downfall.

- fiscal council: An independent Fiscal Council es initially formed by this act to monitor the government’s loyalty to the targets formed by FRBMA (Fiscal Responsibility and Budget management Act.)

I am enclosing an image which describes this matter in a more significant manner and the language used is too easy to understand.

See less

What does the term “public debt” mean to you? Why is a high level of national debt seen as concerning? Talk about it in relation to India. (Answer in 200 words)

-

Public debt, also known as government debt or national debt, refers to the total amount of money owed by a country's government to its citizens, businesses, and foreign investors. It is a cumulative result of budget deficits, borrowing for various purposes, and interest payments. High public debt isRead more

Public debt, also known as government debt or national debt, refers to the total amount of money owed by a country’s government to its citizens, businesses, and foreign investors. It is a cumulative result of budget deficits, borrowing for various purposes, and interest payments.

High public debt is a matter of concern for several reasons:

1. Burden on future generations: High debt may lead to increased taxation and reduced government spending on essential services, affecting future generations.

2. Inflation: Excessive borrowing can lead to inflation, reducing the purchasing power of citizens.

3. Reduced credit rating: High debt may lower a country’s credit rating, increasing borrowing costs and reducing investor confidence.

4. Reduced fiscal space: High debt limits a government’s ability to respond to economic downturns or fund development projects.

In the context of India, high public debt is a concern due to:

– Rising debt to GDP ratio (currently over 90%)

– Large fiscal deficits

– Increasing reliance on market borrowing

– Pressure on interest payments (around 50% of tax revenue)

– Limited fiscal space for development spending

To address these concerns, India needs to focus on fiscal consolidation, improve tax compliance, and enhance economic growth through structural reforms.

See less

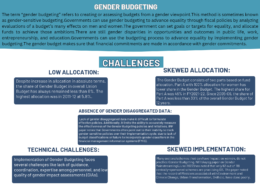

Gender budgeting: What is it? Talk about the difficulties it presents in the Indian setting. (Answer in 200 words)

-

This answer was edited.

.

Roadmap for Answer Writing Introduction: Start with a definition of Outcome Budgeting (OB): Outcome Budgeting is a method that links government spending with specific, measurable results and outcomes, shifting focus from financial allocation to the achievement of developmental goals.Fact to use: “Outcome ...

-

Best Answer

Model Answer Role of Outcome Budgeting in Efficient Allocation of Resources in India Outcome Budgeting (OB) is a strategic framework employed by the Indian government to link budgetary allocations to specific outputs and outcomes. It serves as a tool for improving the efficiency of resource allocatiRead more

Model Answer

Role of Outcome Budgeting in Efficient Allocation of Resources in India

Outcome Budgeting (OB) is a strategic framework employed by the Indian government to link budgetary allocations to specific outputs and outcomes. It serves as a tool for improving the efficiency of resource allocation, ensuring that funds are used to achieve measurable goals. Here’s how Outcome Budgeting plays a pivotal role:

Better Conceptualization of Budgeting

Unlike traditional budgeting, which primarily focuses on financial outlays, Outcome Budgeting emphasizes the desired outcomes from the expenditure. This method requires ministries and departments to plan their budget with a clear focus on achieving specific, measurable results. For instance, by setting clear targets for development schemes, the government ensures that each rupee spent contributes to the expected socio-economic objectives, such as poverty alleviation or infrastructure development.

Defined Outputs and Outcomes

Outcome Budgeting requires clear identification of outputs (the goods or services produced) and outcomes (the impact or benefit derived from these goods or services). This transparency helps ministries plan better and allocate resources more effectively to areas with higher potential for impact. For example, the Pradhan Mantri Fasal Bima Yojana has defined targets like timely claim settlements, which ensures that resources are directed to programs that deliver measurable results.

Cost Reduction and Improved Efficiency

One of the most important aspects of Outcome Budgeting is its ability to identify inefficient expenditure. Schemes that fail to meet their objectives can be reassessed or discontinued, redirecting funds to more effective programs. This helps reduce waste and ensures that taxpayers’ money is spent where it can have the greatest impact.

Supporting Socio-Economic Goals

Outcome Budgeting supports the government’s socio-economic objectives by promoting transparency, accountability, and citizen participation. For example, programs like PM KISAN aim to provide income support to farmers, directly contributing to financial inclusion and rural development. This system also allows for regular evaluations, ensuring that schemes are continuously improved to meet their intended outcomes.

In conclusion, Outcome Budgeting is integral to ensuring that public resources in India are allocated efficiently, with a focus on achieving tangible, positive socio-economic outcomes. By enhancing transparency, targeting priority areas, and fostering accountability, it supports the overarching goal of effective governance.

See less

The Indian government's budget serves three primary functions in the economy: allocation, redistribution, and stabilization. Let's discuss each of these functions in detail: Allocation Function: The allocation function of the government's budget involves the distribution of resources and expenditureRead more

The Indian government’s budget serves three primary functions in the economy: allocation, redistribution, and stabilization. Let’s discuss each of these functions in detail:

In the context of the Indian economy, the government’s budget plays a crucial role in addressing these three functions. The allocation function is evident in the prioritization of investments in areas like infrastructure, education, and healthcare, which are essential for the country’s long-term development

See less