Emphasize the different money supply metrics that the RBI of India uses.

Evaluation of the Reserve Bank of India's (RBI) Monetary Policy The Reserve Bank of India (RBI) has been central to maintaining price stability, supporting economic growth, and managing financial stability. Its effectiveness can be evaluated through its response to normal economic conditions and extRead more

Evaluation of the Reserve Bank of India’s (RBI) Monetary Policy

The Reserve Bank of India (RBI) has been central to maintaining price stability, supporting economic growth, and managing financial stability. Its effectiveness can be evaluated through its response to normal economic conditions and extraordinary challenges, particularly the COVID-19 pandemic and the global macroeconomic environment.

1. Maintaining Price Stability

Pre-COVID Period:

Inflation Targeting: Since adopting an inflation-targeting framework in 2016, the RBI has aimed to keep inflation within the 4% ± 2% range. This framework has brought greater clarity and focus to monetary policy.

Monetary Policy Committee (MPC): The establishment of the MPC has institutionalized decision-making, enhancing the credibility and transparency of the RBI’s actions.

During COVID-19:

Accommodative Stance: The RBI adopted an accommodative stance to mitigate the economic impact of the pandemic, cutting the repo rate by 115 basis points between March and May 2020 to 4.00%.

Liquidity Measures: The RBI implemented several liquidity measures, such as Targeted Long-Term Repo Operations (TLTROs) and Open Market Operations (OMOs), to ensure sufficient liquidity in the banking system.

Effectiveness:

Inflation Management: While the inflation targeting regime initially helped anchor inflation expectations, the pandemic and supply chain disruptions led to higher inflation, often above the upper tolerance band.

Liquidity Impact: The liquidity measures ensured that financial markets remained functional and credit flowed to the economy, but also contributed to inflationary pressures due to increased money supply.

2. Supporting Economic Growth

Pre-COVID Period:

Growth Support: The RBI’s monetary policy aimed to balance growth and inflation. In times of economic slowdown, the RBI reduced interest rates to stimulate demand.

Regulatory Measures: The RBI introduced measures to support sectors like MSMEs, including restructuring schemes and priority sector lending.

During COVID-19:

Rate Cuts: The significant rate cuts were aimed at lowering borrowing costs and stimulating investment and consumption.

Regulatory Forbearance: Measures like loan moratoriums and restructuring packages provided relief to borrowers, helping businesses survive the downturn.

Effectiveness:

Economic Recovery: The RBI’s accommodative policies played a crucial role in supporting economic recovery, particularly in boosting consumption and investment.

Credit Flow: Enhanced liquidity and regulatory forbearance helped maintain credit flow, although the transmission of rate cuts to actual lending rates by banks was gradual.

3. Managing Financial Stability

Pre-COVID Period:

Banking Sector Health: The RBI focused on strengthening the banking sector through measures like the Prompt Corrective Action (PCA) framework for weak banks and asset quality reviews.

Non-Banking Financial Companies (NBFCs): After the IL&FS crisis in 2018, the RBI took steps to regulate NBFCs more stringently, ensuring better risk management and financial stability.

During COVID-19:

Emergency Measures: The RBI provided special liquidity facilities to financial institutions, including NBFCs, housing finance companies, and mutual funds.

Regulatory Relaxations: Temporary relaxations in regulatory norms, such as asset classification and provisioning, were introduced to provide relief to financial institutions.

Effectiveness:

Banking Sector Resilience: The RBI’s preemptive measures strengthened the banking sector’s resilience, but the economic slowdown and subsequent pandemic-induced stress tested this resilience.

NBFC Stability: Liquidity support and regulatory oversight helped stabilize the NBFC sector, though challenges remained in terms of asset quality and liquidity mismatches.

Challenges Posed by the COVID-19 Pandemic and Global Macroeconomic Environment

Supply Chain Disruptions:

Inflationary Pressures: Global supply chain disruptions led to cost-push inflation, complicating the RBI’s inflation management efforts.

Economic Uncertainty: Persistent uncertainty affected consumer and business confidence, impacting economic recovery.

Global Monetary Policy Shifts:

Global Rate Changes: Changes in global interest rates, particularly by major central banks like the Federal Reserve, impacted capital flows and exchange rates, posing challenges for domestic monetary policy.

Capital Flows: Volatility in global capital flows affected the stability of the Indian rupee and external sector balance.

Domestic Economic Challenges:

Growth-Investment Dynamics: Balancing the need for growth with inflation management became more complex due to fluctuating investment patterns and consumer demand.

Fiscal-Monetary Coordination: Ensuring effective coordination between fiscal and monetary policies was crucial for comprehensive economic management, especially given the increased fiscal deficit and debt levels.

Conclusion

The RBI’s monetary policy has been relatively effective in maintaining price stability, supporting economic growth, and managing financial stability, especially in the face of unprecedented challenges posed by the COVID-19 pandemic and a volatile global macroeconomic environment. The adoption of inflation targeting, accommodative monetary stance, liquidity measures, and regulatory forbearance have been pivotal in navigating these challenges. However, ongoing issues such as inflationary pressures, the need for effective transmission of policy rates, and maintaining financial stability amidst global uncertainties continue to test the RBI’s policy framework. The RBI’s adaptive and proactive approach will remain critical in ensuring sustained economic recovery and stability.

The total stock of money in circulation among the public at a particular point of time is called money supply. It consists of currency, printed notes, money in the deposit accounts and in the form of other liquid assets. It does not include other forms of wealth such as long-term investments or physRead more

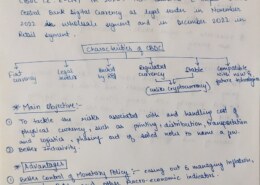

The total stock of money in circulation among the public at a particular point of time is called money supply. It consists of currency, printed notes, money in the deposit accounts and in the form of other liquid assets. It does not include other forms of wealth such as long-term investments or physical assets that must be sold to convert to cash. It also does not include various forms of credit, such as loans, mortgages, and credit cards. The amount of money supply in the economy is crucial as it affects the production, price level, and employment in the economy. The central bank of the country (RBI) publishes following measures of money supply:

Reserve Money (M0): It is the base level for the money supply or the high-powered component of the money supply. It constitutes currency in circulation, Bankers’ deposits with the RBI and ‘other’ deposits with the RBI.

Narrow Money: It typically covers the most liquid form of money that can be easily converted into currency or used for cashless payments for transaction and commerce purposes. RBI publishes M1 and M2 as the two measures of narrow money:

M1: It consists of currency (notes plus coins) held by public and net Demand deposits held with the commercial banks and ‘other’ deposits with the RBI. This is the most liquid and easiest money available for transactions.

M2: It consists of M1 plus Savings deposits with the Post Office Saving banks.

Broad Money: It is a broad classification of money that includes time deposits along with currency in circulation and demand deposits with banks and post offices. They are less liquid than the narrow money. RBI publishes:

M3: It consists of M1 plus net time deposits of commercial banks. It captures the complete balance sheet of the banking sector and is known as aggregate monetary resources. It is the most common measure used for money supply.

M4: M3 plus all deposits with the post office saving banks (excluding National Savings Certificates). Since total deposits with post offices are negligible, there is not much difference between M3 and M4.

In terms of liquidity, these can be arranged as- M1>M2>M3>M4. ‘Other’ deposits with RBI comprise mainly: (i) deposits of quasi-government and other financial institutions including primary dealers, (ii) balances in the accounts of foreign Central banks and Governments, (iii) accounts of international agencies such as the International Monetary Fund, etc. Valuation and analysis of the money supply in the economy helps the policy makers to frame or to alter the monetary policy.

See less