Talk about the necessity of privatizing public sector banks and the issues raised by this move. (Answer in 200 words)

Reserve Bank of India has many tools : 1).Repo Rate, the rate of interest at which banks responsible for the money of RBI borrow from the bank, is Repo Rate. 2).The rate at which the central bank borrows money from commercial banks is called Reverse Repo Rate (RRR). 3).The money in banks that shouldRead more

Reserve Bank of India has many tools :

1).Repo Rate, the rate of interest at which banks responsible for the money of RBI borrow from the bank, is Repo Rate.

2).The rate at which the central bank borrows money from commercial banks is called Reverse Repo Rate (RRR).

3).The money in banks that should be kept ready as cash, which is a part of deposits, is known as the Cash Reserve Ratio (CRR).

4).When a commercial bank keeps at least a predetermined percentage of the customer’s deposits in the form of money, Gold, etc., it is called Statutory Liquidity Ratio ( SLR).

5).Open Market Operations (OMO) stand for buy and sell-out of secur

6).Marginal Standing Facility (MSF) is the instrument of RBI through which scheduled commercial banks can obtain available liquidity overnight.

7).Bank Rate is the rate at which RBI reduces charges and transfers funds to commercial banks.

These instruments enable RBI to act as a banker for:

1).Regulating liquidity and credit growth

2).Maintaining interest rates

3).Promoting financial stability

As a banker for the government, RBI:

1).Manages public finances

2).Acts as a fiscal agent

3).Advances money on behalf of the state

4).Provides advice on matters concerning public spending

In addition, RBI also manages foreign exchange reserves, overseas payment systems in India, and superintends overall financial system stability across the country’s economy.

See less

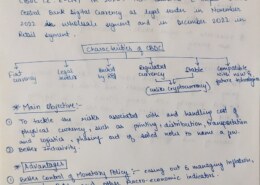

Topic Privatisation of Banks

Topic Privatisation of Banks

See less