What is sterilization, in your opinion? How does the RBI guard against outside shocks by stabilizing the money supply? (Answer in 200 words)

Priority Sector Lending (PSL) mandates increased lending by the banks towards specified sectors and activities in the economy, which may not get timely and adequate credit in the absence of the special dispensation. Presently, categories under priority sector include Agriculture; Micro, Small and MeRead more

Priority Sector Lending (PSL) mandates increased lending by the banks towards specified sectors and activities in the economy, which may not get timely and adequate credit in the absence of the special dispensation. Presently, categories under priority sector include Agriculture; Micro, Small and Medium Enterprises; Export Credit; Education; Housing; Social Infrastructure; Renewable Energy; and Others. The rate of interest on PSL loans is charged as per the directives of the RBI.

Challenges with Priority Sector Lending in India:

- Sectoral issues: Doubling credit to PSL in the agricultural sector leads to an increase of just 11% of total credit in the agricultural sector as compared to 76% in the export sector and 41% in manufacturing sector. Also, agricultural sector’s susceptibility to vagaries of monsoon increases the credit risks of banks under PSL.

- Lethargy in lending: Most public sector banks have been continuously underperforming on the total priority sector target. This may be due to difficulty in finding viable options to lend to the rural areas or the MSME sector.

- Rising NPA: The Second Narasimham Committee (1998) observed that directed credit led to an increase in non-performing loans and adversely affected the efficiency and profitability of banks. It stated that 47% of all non-performing assets have come from the priority sector.

- Costs of PSL in India: It hinders the banks from expanding their scale of lending, consequently, affecting the banking industry and the flow of credit in the economy as a whole. It also impacts the general lending power of banks and deposit rate, which ultimately impact the general public.

Notwithstanding the challenges, PSL has proved useful for the following reasons:

- Promotes equity: It promotes social equity and facilitates increase in employment and investment in less developed regions and gives an impetus to the vulnerable sections of the society.

- Balanced development: Direct lending allows the commercial banks to generate high social returns along with profits and it also contributes to economic development by increasing investment in strategic sectors like exports.

- Credit formalisation: It increases institutional credit (including commercial banks, cooperative banks and societies) to the agriculture sector compared to non-institutional credit (such as money lenders).

Despite the challenges, the policy of priority sector lending (PSL) target has benefitted the vulnerable sections of society, which though creditworthy, are unable to access the formal banking system for adequate and timely credit. In this context, to make the PSL policy more effective, various steps such as Priority Sector Lending Certificates, timely revised guidelines by the RBI, continued increase of the target under PSL year-on-year, etc. have been taken, which are steps in the right direction.

See less

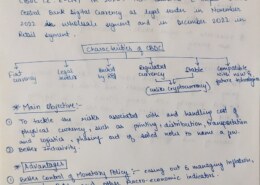

Sterilization refers to the process by which a central bank offsets the effects of foreign exchange interventions on the domestic money supply. When a central bank buys or sells foreign currency to influence exchange rates, it affects the amount of domestic currency in circulation. To neutralize thiRead more

Sterilization refers to the process by which a central bank offsets the effects of foreign exchange interventions on the domestic money supply. When a central bank buys or sells foreign currency to influence exchange rates, it affects the amount of domestic currency in circulation. To neutralize this impact and maintain control over domestic monetary conditions, the central bank conducts sterilization operations.

The Reserve Bank of India (RBI) uses sterilization to stabilize the money supply against external shocks. When there is an influx of foreign capital, leading to an increase in foreign exchange reserves, the RBI might sell government securities to absorb the excess liquidity. Conversely, if there is an outflow of foreign capital, causing a reduction in foreign exchange reserves, the RBI might buy government securities to inject liquidity into the system. This ensures that the money supply remains stable despite external capital flows.

By managing the liquidity through open market operations (OMOs), the RBI can control inflation and interest rates, thereby stabilizing the economy. This is crucial for maintaining economic stability, as uncontrolled fluctuations in the money supply can lead to inflation or deflation, adversely impacting growth and financial stability.

See less