Point out the distinction between depreciation and devaluation in relation to the national currencies. Additionally, describe the elements that influence the Indian Rupee’s value.

- Recent Questions

- Most Answered

- Answers

- No Answers

- Most Visited

- Most Voted

- Random

- Bump Question

- New Questions

- Sticky Questions

- Polls

- Followed Questions

- Favorite Questions

- Recent Questions With Time

- Most Answered With Time

- Answers With Time

- No Answers With Time

- Most Visited With Time

- Most Voted With Time

- Random With Time

- Bump Question With Time

- New Questions With Time

- Sticky Questions With Time

- Polls With Time

- Followed Questions With Time

- Favorite Questions With Time

Mains Answer Writing Latest Questions

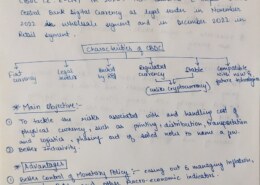

What is CBDC, or Central Bank Digital Currency? Talk about how implementing it in India will affect policy. (Answer in 150 words)

Order of importance India’s sector lending industry has a number of obstacles. Talk about its usefulness as a tool for policy in this situation. (Answer in 150 words)

-

Priority Sector Lending (PSL) mandates increased lending by the banks towards specified sectors and activities in the economy, which may not get timely and adequate credit in the absence of the special dispensation. Presently, categories under priority sector include Agriculture; Micro, Small and MeRead more

Priority Sector Lending (PSL) mandates increased lending by the banks towards specified sectors and activities in the economy, which may not get timely and adequate credit in the absence of the special dispensation. Presently, categories under priority sector include Agriculture; Micro, Small and Medium Enterprises; Export Credit; Education; Housing; Social Infrastructure; Renewable Energy; and Others. The rate of interest on PSL loans is charged as per the directives of the RBI.

Challenges with Priority Sector Lending in India:

- Sectoral issues: Doubling credit to PSL in the agricultural sector leads to an increase of just 11% of total credit in the agricultural sector as compared to 76% in the export sector and 41% in manufacturing sector. Also, agricultural sector’s susceptibility to vagaries of monsoon increases the credit risks of banks under PSL.

- Lethargy in lending: Most public sector banks have been continuously underperforming on the total priority sector target. This may be due to difficulty in finding viable options to lend to the rural areas or the MSME sector.

- Rising NPA: The Second Narasimham Committee (1998) observed that directed credit led to an increase in non-performing loans and adversely affected the efficiency and profitability of banks. It stated that 47% of all non-performing assets have come from the priority sector.

- Costs of PSL in India: It hinders the banks from expanding their scale of lending, consequently, affecting the banking industry and the flow of credit in the economy as a whole. It also impacts the general lending power of banks and deposit rate, which ultimately impact the general public.

Notwithstanding the challenges, PSL has proved useful for the following reasons:

- Promotes equity: It promotes social equity and facilitates increase in employment and investment in less developed regions and gives an impetus to the vulnerable sections of the society.

- Balanced development: Direct lending allows the commercial banks to generate high social returns along with profits and it also contributes to economic development by increasing investment in strategic sectors like exports.

- Credit formalisation: It increases institutional credit (including commercial banks, cooperative banks and societies) to the agriculture sector compared to non-institutional credit (such as money lenders).

Despite the challenges, the policy of priority sector lending (PSL) target has benefitted the vulnerable sections of society, which though creditworthy, are unable to access the formal banking system for adequate and timely credit. In this context, to make the PSL policy more effective, various steps such as Priority Sector Lending Certificates, timely revised guidelines by the RBI, continued increase of the target under PSL year-on-year, etc. have been taken, which are steps in the right direction.

See less

Roadmap for Answer Writing 1. Introduction Define the concept of the savings rate. Fact: “The savings rate measures the share of gross disposable income that is not used in final consumption expenditure.” 2. Impact of Savings Rate on the Economy Long-term Effects: Explain how high savings ...

-

Best Answer

Model Answer Long-Term Impact: A higher savings rate leads to greater capital accumulation, which increases deposits in banks. These deposits are then lent out to businesses, enabling investments in infrastructure, technology, and equipment. This investment drives long-term economic growth, higher iRead more

Model Answer

- Long-Term Impact: A higher savings rate leads to greater capital accumulation, which increases deposits in banks. These deposits are then lent out to businesses, enabling investments in infrastructure, technology, and equipment. This investment drives long-term economic growth, higher incomes, and better living standards. Additionally, a high savings rate helps make the economy more resilient to downturns and reduces dependence on foreign borrowings, thereby shielding the economy from external shocks.

- Short-Term Impact: However, in the short term, an increase in savings reduces consumption expenditure. Lower consumption results in reduced demand for goods and services, which can lead to slower economic growth.

Factors Behind Decline in Savings Rate in India

- Increase in Household Debt: Rising consumption, particularly among younger populations, has led to higher private consumption. This, in turn, has increased financial liabilities, with a surge in credit card spending observed in 2023. As a result, households are saving less.

- Falling or Stagnant Income Levels: Many households, particularly the poorest, are facing declining or stagnant incomes. A study by PRICE revealed that from 2015-16 to 2020-21, the income of the poorest 20% of households dropped by 53%, while the wealthiest 20% saw a 39% increase. This growing income disparity impacts the ability of households to save.

- High Inflation: Persistent inflation has eroded real wages, making it difficult for households to save. The combination of stagnant incomes and rising inflation has put additional strain on savings.

- Exit of High Net-Worth Individuals (HNIs): Between 2017-2022, around 30,000 to 35,000 HNIs left India, taking their savings with them, which further exacerbated the decline in domestic savings.

- Shift to Physical Savings: Low-interest rates have prompted a shift away from financial savings toward physical assets like real estate, as households seek higher returns, contributing to the decline in financial savings.

The decline in domestic savings may necessitate increased reliance on foreign savings, which introduces risks. Restoring high savings, investment, and growth cycles is essential for sustainable long-term growth

See less

Roadmap for Answer Writing When approaching the question “Provide a description of the various instruments at the disposal of the RBI for regulating the money supply in the economy,” your answer should be structured in a clear and systematic way. Below ...

-

Best Answer

Model Answer Instruments Used by the RBI for Regulating Money Supply The Reserve Bank of India (RBI) employs various tools to regulate the money supply in the economy, aiming to balance inflation control with economic growth. These tools can be broadly classified into Quantitative and Qualitative meRead more

Model Answer

Instruments Used by the RBI for Regulating Money Supply

The Reserve Bank of India (RBI) employs various tools to regulate the money supply in the economy, aiming to balance inflation control with economic growth. These tools can be broadly classified into Quantitative and Qualitative measures.

Quantitative Measures

- Open Market Operations (OMO)

The RBI conducts buying and selling of government securities in the open market. By selling securities, it absorbs liquidity from the banking system, thereby reducing the money supply. Conversely, buying securities injects money into the economy, increasing the money supply. - Cash Reserve Ratio (CRR)

CRR is the minimum percentage of a bank’s total deposits that must be kept in reserve, either as cash or with the RBI. Increasing the CRR reduces the liquidity available for lending by commercial banks, thereby controlling credit creation. - Statutory Liquidity Ratio (SLR)

The SLR is the portion of a bank’s net demand and time liabilities (NDTL) that must be invested in government-approved securities. By altering the SLR, the RBI can influence the amount of credit banks can extend. - Liquidity Adjustment Facility (LAF)

The LAF consists of two key rates:- Repo Rate: The rate at which the RBI lends money to commercial banks in times of short-term liquidity shortages. A higher repo rate discourages borrowing and helps reduce money supply.

- Reverse Repo Rate: The rate at which commercial banks park their surplus funds with the RBI. An increase in this rate encourages banks to keep funds with the RBI, thereby reducing liquidity in the economy.

Qualitative Measures

- Margin Requirements

The RBI sets margin requirements, which are the differences between the value of securities pledged by borrowers and the loan amount. This helps control speculative lending and ensures prudent lending practices. - Rationing of Credit

The RBI can ration credit, guiding banks to extend credit to priority sectors like agriculture and education, while restricting loans to less critical sectors. - Moral Suasion

The RBI uses moral suasion by advising commercial banks to adjust their lending policies. This may involve persuading banks to restrict loans for speculative purposes or to focus on sectors in need of credit support.

By combining both Quantitative and Qualitative measures, the RBI effectively manages money supply and promotes economic stability.

See less - Open Market Operations (OMO)

Describe how the RBI serves as a banker to both the government and commercial banks while highlighting the monetary policy tools at its disposal (Answer in 200 words)

-

Reserve Bank of India has many tools : 1).Repo Rate, the rate of interest at which banks responsible for the money of RBI borrow from the bank, is Repo Rate. 2).The rate at which the central bank borrows money from commercial banks is called Reverse Repo Rate (RRR). 3).The money in banks that shouldRead more

Reserve Bank of India has many tools :

1).Repo Rate, the rate of interest at which banks responsible for the money of RBI borrow from the bank, is Repo Rate.

2).The rate at which the central bank borrows money from commercial banks is called Reverse Repo Rate (RRR).

3).The money in banks that should be kept ready as cash, which is a part of deposits, is known as the Cash Reserve Ratio (CRR).

4).When a commercial bank keeps at least a predetermined percentage of the customer’s deposits in the form of money, Gold, etc., it is called Statutory Liquidity Ratio ( SLR).

5).Open Market Operations (OMO) stand for buy and sell-out of secur

6).Marginal Standing Facility (MSF) is the instrument of RBI through which scheduled commercial banks can obtain available liquidity overnight.

7).Bank Rate is the rate at which RBI reduces charges and transfers funds to commercial banks.

These instruments enable RBI to act as a banker for:

1).Regulating liquidity and credit growth

2).Maintaining interest rates

3).Promoting financial stability

As a banker for the government, RBI:

1).Manages public finances

2).Acts as a fiscal agent

3).Advances money on behalf of the state

4).Provides advice on matters concerning public spending

In addition, RBI also manages foreign exchange reserves, overseas payment systems in India, and superintends overall financial system stability across the country’s economy.

See less

Examine the Insolvency and Bankruptcy Code (IBC), the Prompt Corrective Action (PCA) framework, the efforts to strengthen the regulatory and supervisory mechanisms, and the strategies implemented by the RBI to address the problem of non-performing assets (NPAs) in the banking ...

-

The Reserve Bank of India (RBI) has implemented several strategies to address the issue of non-performing assets (NPAs) in the banking sector, aiming to strengthen the resilience and health of the banking system. Let's analyze these strategies and their impacts: 1. Insolvency and Bankruptcy Code (IBRead more

The Reserve Bank of India (RBI) has implemented several strategies to address the issue of non-performing assets (NPAs) in the banking sector, aiming to strengthen the resilience and health of the banking system. Let’s analyze these strategies and their impacts:

1. Insolvency and Bankruptcy Code (IBC):

Objective: The IBC was introduced in 2016 to provide a time-bound framework for resolving insolvency among companies and individuals. It aims to maximize the value of assets, promote entrepreneurship, and ensure timely resolution of stressed assets.Impact:

Speedy Resolution: The IBC has facilitated faster resolution of NPAs by setting strict timelines for resolution processes. This has helped in reducing the amount of time stressed assets remain on bank balance sheets.

Increased Recovery: Banks have been able to recover a higher proportion of their dues through the resolution process compared to earlier mechanisms.

Improved Credit Culture: The threat of insolvency proceedings has encouraged borrowers and lenders to adopt more disciplined credit practices, thereby reducing the incidence of future NPAs.

2. Prompt Corrective Action (PCA) Framework:

Objective: The PCA framework is a supervisory tool used by the RBI to monitor banks’ financial health based on certain performance indicators. It is triggered when banks breach specific thresholds related to capital adequacy, asset quality, profitability, and leverage ratio.Impact:

Risk Mitigation: PCA helps in identifying weak banks early and initiating corrective actions to prevent further deterioration of their financial health.

Capital Conservation: Banks under PCA are restricted from expanding their operations and making risky investments, thereby conserving capital and focusing on resolving their NPAs.

Improving Governance: PCA encourages banks to strengthen their governance and risk management practices to comply with regulatory requirements.

3. Strengthening Regulatory and Supervisory Mechanisms:

Objective: The RBI has continuously enhanced its regulatory and supervisory framework to ensure early detection and resolution of NPAs. This includes improving asset classification norms, provisioning requirements, and stress testing exercises.Impact:

Early Recognition: Improved asset quality review processes have helped in early identification of stressed assets, allowing banks to take timely corrective actions.

See less

Provisioning Norms: Strengthened provisioning norms ensure that banks set aside adequate funds to cover potential losses arising from NPAs, thereby enhancing financial stability.

Enhanced Transparency: Regular disclosures and reporting requirements promote transparency and accountability in the banking sector, fostering investor confidence.

Assessment of Impact on Banking System:

Reduction in NPAs: The combination of IBC, PCA framework, and strengthened regulatory mechanisms has contributed to a reduction in NPAs over time.

Improved Capital Adequacy: Banks have strengthened their capital positions through increased recoveries and prudent risk management practices under the PCA framework.

Enhanced Resilience: The overall resilience of the banking sector has improved with a more proactive approach towards managing stressed assets and enhancing governance standards.

Challenges and Future Directions:

Legal and Operational Challenges: Implementation of the IBC has faced challenges related to legal proceedings, delays in resolution, and operational bottlenecks.

Need for Continuous Monitoring: The RBI needs to continuously monitor the effectiveness of these frameworks and adapt them to evolving market conditions and banking practices.

Support for Recovery: Enhancing the ecosystem for asset reconstruction and supporting distressed asset markets can further facilitate faster resolution of NPAs.

In conclusion, the RBI’s strategies including the IBC, PCA framework, and strengthened regulatory mechanisms have played a crucial role in addressing NPAs and improving the resilience of India’s banking sector. While these measures have shown positive results in reducing NPAs and enhancing governance, ongoing efforts are needed to address challenges and ensure sustainable improvements in the banking sector’s health.

Examine how the RBI manages foreign exchange reserves and the exchange rate regime. Discuss the effects of its interventions on the stability of the external sector, the competitiveness of Indian exports, and the nation’s resilience to shocks from abroad.

-

The Reserve Bank of India (RBI) plays a critical role in managing India's exchange rate regime and foreign exchange reserves, which are pivotal in maintaining the stability of the external sector and enhancing the country's resilience to external shocks. Here’s an analysis of the RBI’s role and theRead more

The Reserve Bank of India (RBI) plays a critical role in managing India’s exchange rate regime and foreign exchange reserves, which are pivotal in maintaining the stability of the external sector and enhancing the country’s resilience to external shocks. Here’s an analysis of the RBI’s role and the impact of its interventions:

RBI’s Role in Managing Exchange Rate Regime:

Determination of Exchange Rate Policies:The RBI formulates and implements exchange rate policies in alignment with broader economic objectives such as promoting export competitiveness, maintaining price stability, and managing capital flows.

India follows a managed floating exchange rate regime where the RBI intervenes in the foreign exchange market to curb excessive volatility and achieve stability.

Intervention Mechanisms:Market Operations: The RBI conducts market operations through buying and selling foreign exchange to stabilize the exchange rate and manage liquidity in the forex market.

Forward Contracts: It offers forward contracts to provide hedging opportunities for importers, exporters, and investors against exchange rate risks.

Management of Foreign Exchange Reserves:

Purpose and Composition:Reserve Adequacy: Foreign exchange reserves serve as a buffer to meet external payment obligations, stabilize the currency, and absorb shocks in times of financial stress.

Composition: Reserves are held in major convertible currencies and gold, providing liquidity and confidence to the financial markets.

RBI’s Strategy:The RBI actively manages foreign exchange reserves through prudent investment strategies to optimize returns while ensuring liquidity and safety.

It monitors global economic developments and market conditions to make informed decisions on reserve management and allocation.

Impact of RBI’s Interventions:

Competitiveness of Indian Exports:Managed Depreciation: Interventions to manage the exchange rate can include allowing depreciation of the rupee against major currencies, which enhances the competitiveness of Indian exports by making them more price-competitive in international markets.

Export Promotion: A competitive exchange rate supports export-oriented industries, contributing to economic growth and employment generation.

Stability of the External Sector:Reduced Vulnerability: Adequate foreign exchange reserves and effective exchange rate management reduce vulnerability to external shocks such as sudden capital outflows or adverse global economic conditions.

Balanced External Accounts: Interventions help maintain a sustainable balance in the current account by managing trade deficits and promoting stability in the balance of payments.

Ability to Withstand External Shocks:Resilience: Ample foreign exchange reserves and a stable exchange rate regime bolster India’s ability to withstand external shocks, such as fluctuations in global oil prices, geopolitical tensions, or financial market volatilities.

See less

Investor Confidence: A stable currency and robust reserves enhance investor confidence in the economy, attracting foreign investment inflows and supporting economic development.

Challenges and Future Directions:

Global Economic Uncertainty: Continued vigilance is required to navigate uncertainties arising from global economic conditions, including trade tensions and monetary policy shifts in major economies.

Capital Flows Management: Balancing the need for attracting foreign capital inflows with maintaining exchange rate stability and financial sector resilience remains a challenge.

Technological Advancements: Embracing technological advancements in financial markets and payment systems requires ongoing adaptation of regulatory frameworks and surveillance mechanisms.

In conclusion, the RBI’s role in managing the exchange rate regime and foreign exchange reserves is crucial for promoting export competitiveness, ensuring stability in the external sector, and enhancing India’s resilience against external shocks. Effective management of these aspects contributes significantly to maintaining economic stability and fostering sustainable growth in the country.

Outlining the many uses for money, discuss its advantages over other kinds of assets.(Answer in 200 words)

-

This answer was edited.

.

Examine how the RBI balances its many goals, including price stability, financial stability, and economic growth. Then, analyze the difficulties and trade-offs it faces and assess the tactics it uses to manage these intricate policy dynamics.

-

Challenges and Trade-Offs Faced by RBI in Balancing Multiple Objectives The Reserve Bank of India (RBI) is tasked with balancing several crucial objectives: price stability, financial stability, and economic growth. Each of these goals often requires distinct and sometimes conflicting policy measureRead more

Challenges and Trade-Offs Faced by RBI in Balancing Multiple Objectives

The Reserve Bank of India (RBI) is tasked with balancing several crucial objectives: price stability, financial stability, and economic growth. Each of these goals often requires distinct and sometimes conflicting policy measures. The RBI’s approach involves navigating complex policy dynamics and making strategic decisions to manage these trade-offs effectively.

1. Price Stability vs. Economic Growth

a. Inflation Control: Price stability is a primary objective for the RBI, aimed at keeping inflation within target ranges. High inflation erodes purchasing power and can destabilize the economy. For instance:

- Inflation Spike (2022): In 2022, India experienced elevated inflation driven by global supply chain disruptions and rising commodity prices. The RBI responded by tightening monetary policy through interest rate hikes to curb inflation.

b. Economic Growth Trade-Off: Tight monetary policy to control inflation can slow down economic growth. High-interest rates can reduce consumer spending and business investments. Recent examples include:

- COVID-19 Pandemic Response (2020-2021): During the pandemic, the RBI had to lower interest rates and implement quantitative easing measures to support economic growth amidst a sharp economic contraction. However, this led to concerns about potential future inflationary pressures.

2. Financial Stability vs. Economic Growth

a. Regulatory Measures: Financial stability involves ensuring that the banking sector and financial markets are resilient to shocks and crises. Measures to enhance financial stability may include stricter regulations and higher capital requirements for banks. For example:

- Banking Sector Reform (2023): The RBI introduced new guidelines for banks regarding digital lending and cybersecurity to mitigate systemic risks and protect financial stability.

b. Trade-Off with Growth: While stringent regulations bolster financial stability, they can also restrict the availability of credit and slow down economic growth. The RBI needs to balance these aspects carefully. For instance:

- NBFC Sector Regulation: In response to the IL&FS crisis, the RBI imposed tighter regulations on NBFCs, which, while enhancing financial stability, impacted credit availability for sectors dependent on NBFC financing.

3. Price Stability vs. Financial Stability

a. Interest Rate Policies: The RBI’s monetary policy decisions to control inflation (through interest rate adjustments) can affect financial stability. High-interest rates can increase the risk of defaults, especially in sectors with high debt levels. For example:

- Rate Hikes and Borrower Stress (2024): Recent interest rate hikes to combat inflation have increased the cost of borrowing, leading to concerns about the financial health of highly leveraged businesses and households.

b. Managing Trade-Offs: The RBI must carefully calibrate its interest rate policies to avoid exacerbating financial instability while targeting inflation. For instance:

- Inflation Management with a Focus on Stability: The RBI has used a gradual approach to interest rate hikes to balance inflation control with minimizing disruptions to financial stability.

4. Central Bank Strategies to Navigate Policy Dynamics

a. Clear Communication: The RBI uses clear and transparent communication to manage market expectations and mitigate uncertainty. For example:

- Monetary Policy Statements: The RBI’s regular statements and reports provide guidance on future policy directions, helping businesses and investors make informed decisions and reducing market volatility.

b. Flexible Policy Framework: The RBI employs a flexible policy framework that allows it to adjust its approach based on evolving economic conditions. For example:

- Flexible Inflation Targeting (FIT): The RBI follows a flexible inflation targeting framework, which allows it to accommodate short-term deviations from the inflation target in the context of overall macroeconomic stability.

c. Macroprudential Measures: The RBI implements macroprudential measures to safeguard financial stability without compromising economic growth. For instance:

- Countercyclical Capital Buffers: The RBI requires banks to maintain additional capital buffers during economic booms, which can be drawn upon during downturns to stabilize the financial system.

d. Coordination with Government Policies: The RBI coordinates with government fiscal policies to address broader economic issues. For example:

- Economic Stimulus Packages: During economic downturns, the RBI collaborates with the government on stimulus measures, such as fiscal spending and tax incentives, to support growth while managing inflationary pressures.

Conclusion

The RBI faces significant challenges in balancing price stability, financial stability, and economic growth. The trade-offs involved require careful consideration of how monetary and regulatory policies affect each objective. By employing strategies such as clear communication, flexible policy frameworks, macroprudential measures, and coordination with government policies, the RBI strives to navigate these complex dynamics and maintain a stable and growing economy. Recent examples highlight the central bank’s adaptive approach in addressing evolving economic conditions and balancing its multiple objectives.

See less

Both depreciation and devaluation highlight an economic condition when there is a decrease in the value of the domestic currency in comparison to any other foreign currency, leading to a decline in the purchasing power of the domestic currency. However, the manner in which they occur is different. TRead more

Both depreciation and devaluation highlight an economic condition when there is a decrease in the value of the domestic currency in comparison to any other foreign currency, leading to a decline in the purchasing power of the domestic currency. However, the manner in which they occur is different. The differences between depreciation and devaluation are:

Some of the factors that affect the value of the Indian Rupee include:

Any change in the value of the rupee has significant implications on the economy and policy making. Therefore, it requires careful maneuvering to manage macroeconomic indicators at optimum levels.

See less