Describe the several steps the RBI has taken to regulate credit in the economy.

RBI's Initiatives to Strengthen Banking Sector Governance and Risk Management The Reserve Bank of India (RBI) has undertaken several initiatives to bolster governance and risk management practices within the banking sector. These initiatives focus on implementing global standards such as Basel capitRead more

RBI’s Initiatives to Strengthen Banking Sector Governance and Risk Management

The Reserve Bank of India (RBI) has undertaken several initiatives to bolster governance and risk management practices within the banking sector. These initiatives focus on implementing global standards such as Basel capital and liquidity norms, refining bank board compositions, and addressing related-party lending issues. These efforts are aimed at enhancing the soundness and resilience of the banking system.

1. Implementation of Basel Capital and Liquidity Standards

Basel Framework: The Basel standards are global regulatory frameworks developed by the Basel Committee on Banking Supervision. They focus on strengthening banks’ capital requirements, risk management, and liquidity standards.

Recent Developments:

- Basel III Implementation: The RBI has been progressively implementing Basel III standards since 2013. Key aspects include:

- Capital Adequacy: Introduction of stricter capital requirements, including Common Equity Tier 1 (CET1) capital and a minimum Capital Conservation Buffer (CCB).

- Liquidity Requirements: Implementation of the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure that banks maintain sufficient liquid assets to meet short-term and long-term liquidity needs.

- Latest Updates (2024): The RBI has incorporated additional Basel III reforms, including enhanced disclosure requirements and adjustments to the Leverage Ratio to better capture off-balance-sheet exposures and ensure comprehensive risk management.

Impact and Potential: These standards have strengthened banks’ capital bases and liquidity profiles, reducing the likelihood of financial instability. The adoption of Basel III has improved banks’ ability to absorb shocks and maintain operational stability, enhancing overall resilience in the banking sector.

2. Guidelines on the Composition of Bank Boards

Governance Framework: Effective governance is critical for ensuring sound risk management and operational integrity in banks. The RBI has established guidelines for the composition and functioning of bank boards to promote better governance practices.

Recent Developments:

- Board Composition Guidelines (2022): The RBI has issued guidelines requiring banks to have diverse and independent boards. Key requirements include:

- Independent Directors: Mandatory appointment of independent directors to provide objective oversight and minimize conflicts of interest.

- Audit and Risk Committees: Enhanced roles for audit and risk management committees to ensure rigorous oversight of financial reporting and risk management practices.

- Recent Updates (2024): The RBI has further strengthened these guidelines by requiring periodic performance evaluations of board members and mandating specific qualifications and expertise for board positions.

Impact and Potential: These guidelines aim to enhance the effectiveness and independence of bank boards, leading to more robust governance structures. Improved board oversight helps in better decision-making, risk management, and adherence to regulatory requirements, thereby supporting the stability and integrity of the banking system.

3. Measures to Address Related-Party Lending

Related-Party Transactions: Related-party lending involves transactions between a bank and entities or individuals with whom it has a close relationship, potentially leading to conflicts of interest and financial instability.

Recent Developments:

- Tightened Regulations (2023): The RBI has introduced stricter regulations on related-party transactions, including:

- Disclosure Requirements: Banks must disclose related-party transactions and ensure they are conducted at arm’s length.

- Limits on Exposure: Caps have been set on the aggregate exposure to related parties to prevent excessive risk concentration.

- Additional Measures (2024): Enhanced scrutiny and reporting requirements have been imposed to ensure compliance and transparency in related-party lending practices.

Impact and Potential: These measures aim to mitigate the risks associated with related-party lending by ensuring transparency and reducing the potential for conflicts of interest. By limiting exposure and enhancing disclosure, the RBI helps to prevent financial mismanagement and maintain the integrity of the banking sector.

Evaluation of RBI’s Initiatives

Advantages:

- Enhanced Risk Management: Basel III standards and improved board governance practices have significantly strengthened banks’ risk management frameworks, making them more resilient to economic shocks.

- Improved Governance: Strengthening the composition of bank boards and regulating related-party transactions have led to better oversight, reduced conflicts of interest, and more effective risk management.

- Increased Transparency: Enhanced disclosure and reporting requirements improve transparency and accountability within the banking sector.

Challenges:

- Implementation Costs: Adhering to Basel III norms and new governance guidelines can be resource-intensive for banks, particularly smaller institutions.

- Ongoing Compliance: Ensuring continuous compliance with evolving regulations requires robust internal controls and regular oversight.

In conclusion, the RBI’s initiatives, including the implementation of Basel capital and liquidity standards, the enhancement of bank board governance, and measures to address related-party lending, have significantly improved the soundness and resilience of the Indian banking sector. These efforts contribute to a more stable and reliable financial system, better equipped to handle economic fluctuations and financial challenges.

See less

Credit Control means the regulation of the creation and contraction of credit in the economy. It is an important function of the central bank of any country. In India, the Reserve Bank of India (RBI) controls credit in the economy using various quantitative and qualitative measures. Quantitative meaRead more

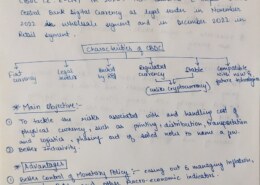

Credit Control means the regulation of the creation and contraction of credit in the economy. It is an important function of the central bank of any country. In India, the Reserve Bank of India (RBI) controls credit in the economy using various quantitative and qualitative measures.

Quantitative measures: These are deployed to regulate the volume of credit created by the banking system.

Qualitative measures: These are deployed to regulate the flow of credit in specific uses

- Marginal requirements: It is the difference between the market value of the security and its maximum loan value. The RBI can increase or decrease the marginal requirement to affect the credit flow.

- Consumer Credit Regulation: The RBI can control the consumer credit by changing the amount that can be borrowed for the purchase of the consumer durables or by changing the maximum period over which the installments can be extended.

- Rationing of credit: In this, the RBI seeks to limit the maximum amount of loans and advances and, also in certain cases, fix ceilings for specific categories of loans and advances.

- Moral Suasion: Here, the RBI tries to morally persuade the banks to cooperate in implementing its policies.

- Direct Action: This step is taken by the RBI against banks that don’t fulfil conditions and requirements. It may involve refusal to rediscount their papers, charging a penal rate of interest over and above the Bank rate etc. It must be noted the effectiveness of credit control measures in an economy depends upon a number of factors and one or more of these measures are adopted by RBI based on the situation.

See less