Roadmap for Answer Writing 1. Introduction Definition of Twin Deficit: Briefly define the Twin Deficit problem as the situation where a country experiences both a Fiscal Deficit (government’s expenditure exceeds its revenue) and a Current Account Deficit (CAD) (imports exceed exports and ...

The government has undertaken several initiatives aimed at integrating the informal sector into the formal economy, with the goal of improving the productivity and resilience of the overall economy. One key initiative is the expansion of social security coverage to include workers in the informal seRead more

The government has undertaken several initiatives aimed at integrating the informal sector into the formal economy, with the goal of improving the productivity and resilience of the overall economy.

One key initiative is the expansion of social security coverage to include workers in the informal sector. This includes measures such as the introduction of targeted social security schemes, like pension and health insurance programs, that cater to the needs of informal workers. By providing a safety net and access to essential services, these initiatives can help improve the well-being and financial security of informal sector workers, potentially incentivizing them to join the formal economy.

Another important initiative is the simplification of business regulations and the easing of requirements for registering and operating formal enterprises. This can help lower the barriers to entry for informal businesses, making it easier for them to transition into the formal sector. Reduced bureaucratic hurdles and compliance costs can make it more attractive for informal businesses to register and operate within the formal framework.

The potential impacts of these initiatives on the overall economy include:

- Increased productivity: By integrating the informal sector into the formal economy, businesses can gain access to resources, financing, and support services that can help improve their productivity and competitiveness. This can lead to higher output, greater efficiency, and more sustainable growth.

- Improved resilience: Formalizing the informal sector can help strengthen the overall economic resilience by diversifying the sources of economic activity, reducing vulnerability to shocks, and increasing the tax base for the government to mobilize resources for social welfare and macroeconomic stabilization.

- Enhanced social protection: Extending social security coverage to informal workers can help improve their living standards, reduce income insecurity, and promote more inclusive development, which can have positive spillover effects on the broader economy.

- Increased tax revenue: As more businesses and workers transition to the formal sector, the government can expand its tax base, leading to increased tax revenue that can be used to fund public services and infrastructure development.

However, the impact of these initiatives may be constrained by various factors, such as the persistence of deep-rooted informality, the availability of suitable incentives and support mechanisms for informal businesses, the capacity of government agencies to effectively implement and monitor the initiatives, and the broader economic and political context.

Additionally, it will be crucial to ensure that the formalization process is inclusive and does not inadvertently disadvantage or marginalize certain segments of the informal sector, such as micro-enterprises or vulnerable workers. Careful design and implementation of these initiatives, coupled with ongoing monitoring and evaluation, will be necessary to maximize their positive impact on the overall economy.

See less

Model Answer The Twin Deficit problem refers to a situation where a country simultaneously experiences both a fiscal deficit and a current account deficit (CAD). 1. Fiscal Deficit A fiscal deficit occurs when a government’s total expenditure exceeds its total revenue, requiring the government to borRead more

Model Answer

The Twin Deficit problem refers to a situation where a country simultaneously experiences both a fiscal deficit and a current account deficit (CAD).

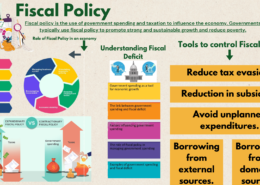

1. Fiscal Deficit

A fiscal deficit occurs when a government’s total expenditure exceeds its total revenue, requiring the government to borrow to cover the gap. This is a measure of a country’s financial health and reflects the government’s borrowing requirements for the year.

2. Current Account Deficit (CAD)

A current account deficit arises when a country imports more goods, services, and capital than it exports, resulting in an outflow of foreign exchange. This imbalance increases the country’s reliance on foreign borrowing or investment to finance the deficit.

Impact of the Twin Deficit Problem on the Indian Economy

When the government borrows heavily to finance its fiscal deficit, it competes with private investors for available capital. This leads to higher interest rates, reducing the resources available for private sector investment and slowing down economic growth.

Source: Monthly Economic Review, Ministry of Finance

A high current account deficit puts downward pressure on the national currency. As the demand for foreign currency increases to pay for imports, the value of the rupee declines. This depreciation makes imports, including essential commodities like crude oil, more expensive.

Source: Ministry of Finance, RBI

A weaker rupee increases the cost of imports, which in turn leads to higher payments in foreign currencies. This drains the country’s foreign exchange reserves, reducing its ability to meet future import obligations or manage external shocks.

Source: RBI

If the current account deficit is not financed by foreign investment, the government must borrow more, leading to rising national debt. This further exacerbates fiscal deficits and increases the burden on future generations.

Source: Ministry of Finance

The depreciation of the rupee and higher import costs, particularly for essential goods like fuel, contribute to inflationary pressures. This reduces the purchasing power of consumers and increases the cost of living.

Source: RBI, Ministry of Finance

A sustained fiscal deficit can harm India’s sovereign credit rating. A downgrade in the rating could make it difficult for the government to raise funds in international markets, reducing foreign investment inflows.

Measures to Address the Twin Deficit Problem

The government must prioritize capital expenditure over non-essential spending to reduce the fiscal deficit.

Adhering to the targets outlined in the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, such as reducing the fiscal deficit to 4.5% of GDP by 2025-26, will help stabilize fiscal health.

Source: Ministry of Finance

Promoting the Aatmanirbhar Bharat initiative can reduce reliance on imports and increase exports, helping to mitigate the current account deficit.

Source: Government of India

The government can enhance tax-based revenues and reduce subsidies, while focusing on disinvestment in public enterprises to control the fiscal deficit.

Conclusion

The Twin Deficit problem poses a significant challenge to India’s macroeconomic stability. By addressing both fiscal and current account deficits through prudent fiscal policies, export promotion, and reducing import dependency, the country can mitigate the negative impacts of this issue. Effective management of public debt and macroeconomic stabilization measures will help achieve long-term economic sustainability.

See less