Explain the meaning and process of credit creation by commercial banks ?

Process States Explanation: In operating systems, a process is a program in execution. As a process runs, it goes through different states. These states represent the current condition of the process in the system. Let's break down the main process states: 1. New: The process is being created. 2. ReRead more

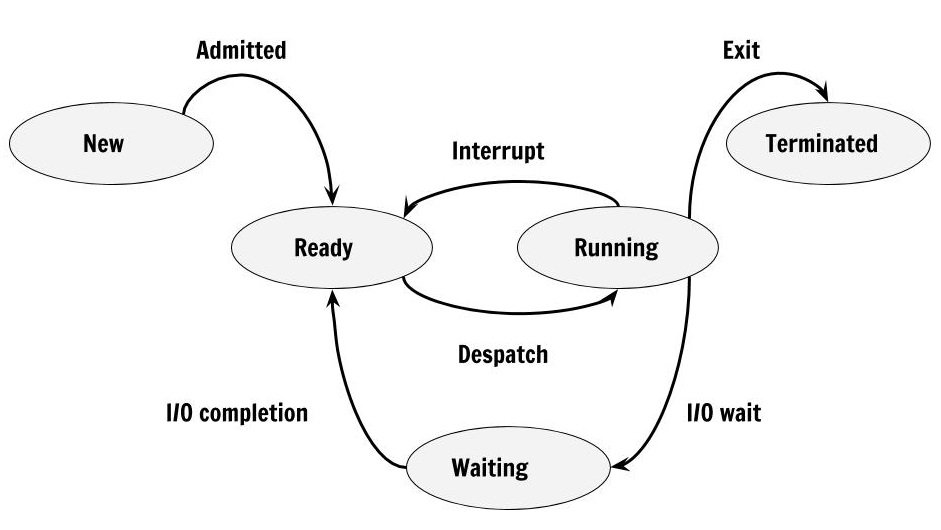

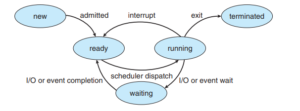

Process States Explanation:

In operating systems, a process is a program in execution. As a process runs, it goes through different states. These states represent the current condition of the process in the system. Let’s break down the main process states:

1. New: The process is being created.

2. Ready: The process is waiting to be assigned to a processor.

3. Running: The process is currently executing on the processor.

4. Waiting (or Blocked): The process is waiting for some event to occur (like I/O completion).

5. Terminated: The process has finished execution.

Examples:

1. New: When you double-click on an application icon, the operating system creates a new process.

2. Ready: Multiple programs open on your computer, waiting for their turn to use the CPU.

3. Running: The video game you’re currently playing.

4. Waiting: When you click “Save” in a document and wait for it to complete.

5. Terminated: When you close an application, and it finishes its execution.

Now, let’s visualize these states with a diagram:

Explanation of the diagram:

1. A new process starts in the “New” state.

2. It then moves to the “Ready” state, waiting for the CPU.

3. When the scheduler selects it, it goes to the “Running” state.

4. From “Running,” it can:

a) Go back to “Ready” if its time slice expires.

b) Move to “Waiting” if it needs to wait for a resource or event.

c) Proceed to “Terminated” if it completes execution.

5. From “Waiting,” it returns to “Ready” when the waited-for event occurs.

This cycle continues until the process terminates.

See less

Credit creation is the process by commercial banks to increase the money supply of a country or monetary region. In most modern economics, most of the money supply is in the form of bank deposits. So credit creation is also known as ‘Deposit Creation.’ Commercial banks create credit by advancing loaRead more

Credit creation is the process by commercial banks to increase the money supply of a country or monetary region. In most modern economics, most of the money supply is in the form of bank deposits. So credit creation is also known as ‘Deposit Creation.’

Commercial banks create credit by advancing loans and purchasing securities. Banks use public deposits to lend money to businesses or individuals. It doesn’t mean they simply lend the money which they deposit. Banks use a method which is called fractional reserve banking. Where they use a portion of the deposit to provide loans with high interest rates.

Basic concepts of credit creation:-

Now let’s understand the process by the Example:–

Assume, A person deposits Rs.10,000 in Bank ‘A’. As required the banks keep LRR 20% of the deposit of Rs. 2000 and Then Bank ‘A’ lends the remaining amount to Bank ‘B’ (10,000-2,000 = Rs.8,000)

Again, Bank ‘B’ keeps LRR 20% of Rs.8,000 means Rs.1,600 then lends the remaining amount to any business. (8,000- – 1,600 = Rs.6,400)

The money goes on multiplying in this way this process continues till new deposits become nil.

Ultimately, Total money creation = INITIAL DEPOSIT * 1/LRR%

10,000 * 1/20% = Rs. 50,000

See less