Roadmap for Answer Writing 1. Introduction to the Balance of Payments (BoP) Define the Balance of Payments (BoP): Definition: The Balance of Payments (BoP) is a systematic record of all economic transactions between residents of a country and the rest of the world ...

Model Answer Resilience of India's External Sector Despite Adverse Global Conditions India's external sector has exhibited notable resilience and sustainability in recent times, even amid unfavorable global conditions such as geopolitical tensions, rising commodity prices, and global trade slowdownsRead more

Model Answer

Resilience of India’s External Sector Despite Adverse Global Conditions

India’s external sector has exhibited notable resilience and sustainability in recent times, even amid unfavorable global conditions such as geopolitical tensions, rising commodity prices, and global trade slowdowns. Here’s an analysis of the factors that demonstrate India’s external sector’s robustness:

Surging Exports Amid Global Slowdown

Despite a global demand slowdown, India’s exports surged by 14%, reaching a record $770 billion in FY23. This reflects the adaptability and competitiveness of India’s export sectors, even in challenging times. This surge is indicative of the country’s ability to navigate global uncertainties while maintaining its trade momentum.

Moderate Current Account Deficit (CAD)

India recorded a CAD of 2% of GDP in 2022-23, a slight increase from the previous year. While this deficit is a concern, it remains within manageable limits compared to global norms, indicating the stability of India’s external balance despite global disruptions.

Strong Foreign Exchange Reserves

India’s foreign exchange reserves rose to $595 billion by June 2023, providing a cushion against external shocks. With an import cover of 10.2 months, this is a significant improvement from 1991, showcasing the country’s improved financial stability and ability to weather global financial challenges.

Robust Services Exports and Remittances

Services exports, particularly in IT and business services, saw net receipts rise from $51.4 billion in H1FY22 to $65.5 billion in H1FY23. Additionally, remittances saw a record increase of 24.4% in 2022, reaching $111 billion, which accounted for 63% of South Asia’s total remittance flows. This sector’s strength is vital in balancing India’s trade deficit.

External Debt and Exchange Rate Stability

India’s external debt remains manageable, around 20% of GDP, thanks to prudent fiscal policies. The country’s exchange rate has also remained relatively stable, especially when compared to other emerging economies facing volatility in the global financial markets.

Conclusion

India’s external sector has indeed shown resilience and adaptability in the face of global challenges. Government initiatives like Free Trade Agreements (FTAs) and the National Logistics Policy 2022 aim to further enhance India’s external sector competitiveness and mitigate future risks, ensuring sustainable growth moving forward.

Model Answer Definition of Balance of Payments (BoP) The Balance of Payments (BoP) is a systematic record of all economic transactions between the residents of one country and the rest of the world over a specific period. It includes imports and exports of goods, services, capital flows, and transfeRead more

Model Answer

Definition of Balance of Payments (BoP)

The Balance of Payments (BoP) is a systematic record of all economic transactions between the residents of one country and the rest of the world over a specific period. It includes imports and exports of goods, services, capital flows, and transfer payments like foreign aid and remittances. The BoP helps assess the economic health of a country by tracking how much it is earning and spending internationally.

Components of the Balance of Payments

The current account records all transactions related to the import and export of goods, services, and transfer payments. It is divided into three sub-components:

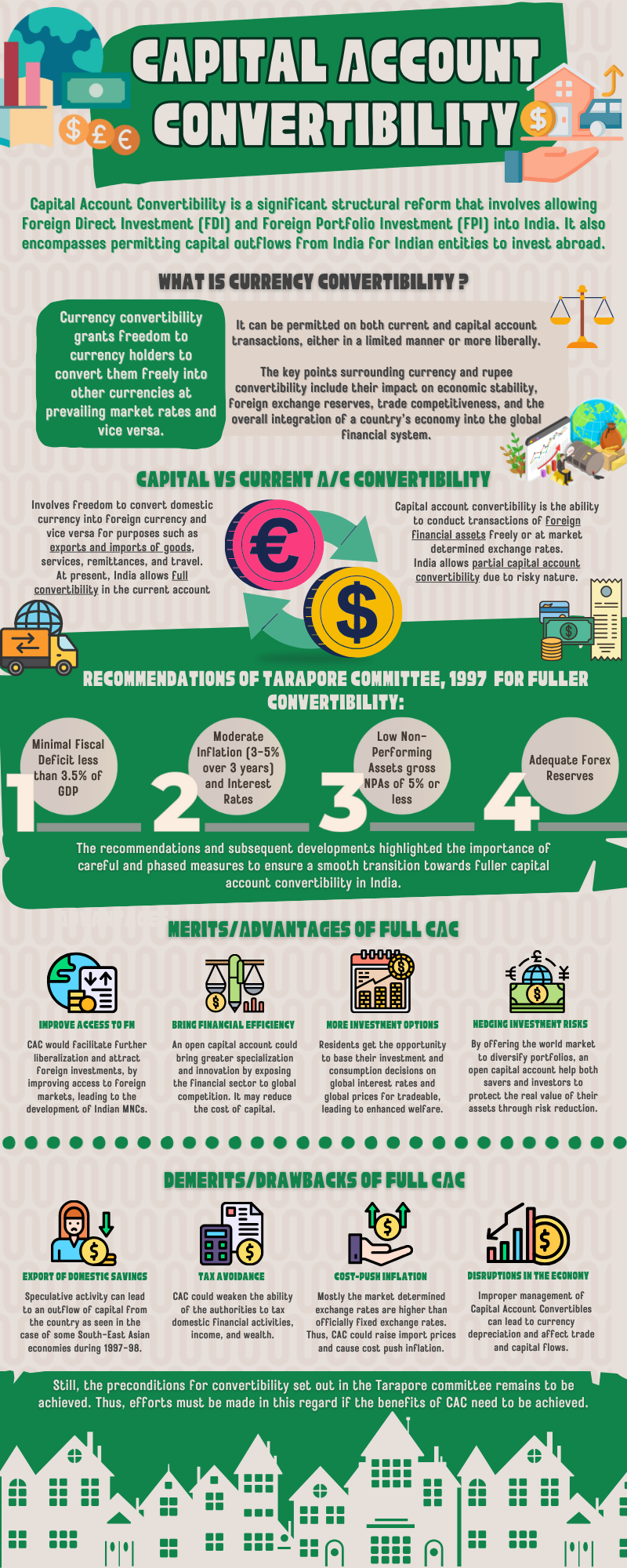

The capital account tracks the purchase and sale of assets, including foreign direct investment (FDI), foreign portfolio investment (FPI), loans, and remittances from Non-Resident Indians (NRIs).

This account records changes in the country’s reserves, such as foreign currencies, gold, Special Drawing Rights (SDRs), and its reserve position in the International Monetary Fund (IMF).

This is a balancing item that accounts for any discrepancies due to the difficulty in recording all international transactions accurately.

Consequences of a BoP Deficit

A BoP deficit occurs when a country’s spending exceeds its earnings from abroad. This can have several negative implications:

For example, during the 1991 Indian economic crisis, India faced a BoP deficit and had to pledge gold reserves to secure loans from the IMF, which led to economic liberalization (Source: IMF, 1991).

See less