Draw attention to the key components of the Goods and Services Tax. Give a summary of its successes since implementation as well as the difficulties it continues to confront. (Answer in 200 words)

The Indian Constitution requires the government to present before the Parliament a statement of its estimated receipts and expenditures in respect of every financial year which runs from 1 April to 31 March (Article 112). This 'Annual Financial Statement' constitutes the main budget document of theRead more

The Indian Constitution requires the government to present before the Parliament a statement of its estimated receipts and expenditures in respect of every financial year which runs from 1 April to 31 March (Article 112). This ‘Annual Financial Statement’ constitutes the main budget document of the government. Objectives of government budgeting include:

- Allocation of resources: The government provides certain goods and services which cannot be provided by the market mechanism i.e. by an exchange between individual consumers and producers. Examples of such goods are national defense, roads, government administration, etc. which are referred to as public goods.

- Redistribution: The government sector affects the personal disposable income of households by making transfers and collecting taxes. It is through the budget that the government can change the distribution of income and bring about a distribution that is considered ‘fair’ by society.

- Economic stabilization: In any period, the level of demand may not be sufficient for the full utilization of labor and other resources of the economy. Since wages and prices do not fall below a level, employment cannot be brought back to the earlier level automatically. The government needs to intervene to raise the aggregate demand.

Components of a budget: There are two accounts in the budget. One that relates to the current financial year only is included in the revenue account, also called the revenue budget. The second component is concerned with the assets and liabilities of the government in the capital account, also called a capital budget. Revenue budget:

- Revenue receipts: Revenue receipts are those receipts that do not lead to a claim on the government. They are therefore termed non-redeemable. They are divided into tax and non-tax revenues.

- Revenue expenditure: Revenue expenditure is the expenditure incurred for purposes other than the creation of physical or financial assets of the central government. It relates to those expenses incurred for the normal functioning of the government departments and various services, interest payments on debt incurred by the government, and grants given to state governments and other parties.

Capital budget:

- Capital receipts: The government receives money by way of loans or from the sale of its assets. Loans will have to be returned to the agencies from which they have been borrowed. Thus, they create liability. Disinvestment, as a component, is a component of capital receipts.

- Capital expenditure: There are expenditures of the government that result in the creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, buildings, machinery, equipment, investment in shares, and loans and advances by the central government to state and union territory governments, PSUs, and other parties.

The budget, it has been argued, reflects and shapes, and is, in turn, shaped by the country’s economic life.

See less

Goods and Services Tax (GST) is an indirect tax that came into effect on 1st July 2017 by replacing many indirect taxes in India such as the excise duty, VAT, services tax, etc. Goods and Service Tax (GST) is levied on the supply of goods and services and is a destination-based tax that is levied onRead more

Goods and Services Tax (GST) is an indirect tax that came into effect on 1st July 2017 by replacing many indirect taxes in India such as the excise duty, VAT, services tax, etc. Goods and Service Tax (GST) is levied on the supply of goods and services and is a destination-based tax that is levied on every value addition.

Salient features of the Goods and Services Tax:

Since its implementation in 2017, the GST has achieved the following milestones:

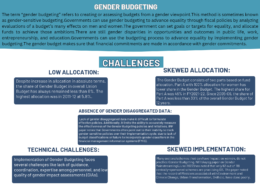

However, several challenges still need to be addressed, such as:

While the government has worked to solve many issues, considerable intervention is still required to bring GST to its full efficiency. The proposal to have a single return will simplify compliance and do away with matching requirements. Such a step will bring out the true sense of ‘One Nation, One Tax’.

See less