Justice in Indian judiciary system is many times delayed and had very big process.What are some ways in which Indian Judiciary system could be improved?

The financial relations between the Centre and the States in India are crucial for maintaining fiscal federalism.These relations are outlined in the Constitution of India, primarily in Articles 268 to 293. 1. Taxation Powers: - The Constitution demarcates the taxation powers between the CentrRead more

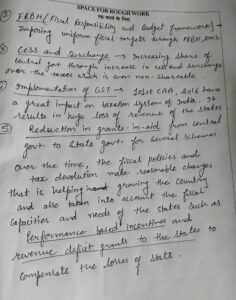

The financial relations between the Centre and the States in India are crucial for maintaining fiscal federalism.These relations are outlined in the Constitution of India, primarily in Articles 268 to 293.

1. Taxation Powers:

– The Constitution demarcates the taxation powers between the Centre and the States.

– The Union List includes taxes like income tax, customs duties, and excise duties, while the State List covers taxes like land revenue, excise on alcohol, and stamp duties.

2.Revenue Sharing:

– Article 270 provides for the sharing of taxes between the Centre and the States, based on the recommendations of the Finance Commission.

– The Goods and Services Tax (GST), implemented through the 101st Amendment, is a major example of cooperative federalism in taxation, with revenues shared between the Centre and the States.

3. Grants-in-Aid:

– Article 275 provides for grants-in-aid from the Centre to States, especially those in need of assistance to meet their expenses.

– Special grants and loans are also provided to states under various central schemes.

4. Finance Commission:

– The Finance Commission, constituted every five years, recommends the distribution of tax revenues between the Centre and the States.

– It ensures a balanced fiscal relationship and addresses disparities among states.

The financial relations between the Centre and the States are designed to ensure a balanced distribution of financial resources, maintaining the federal structure. While challenges remain, mechanisms like the Finance Commission and GST Council aim to promote cooperative federalism and equitable development.

See less

Enhancing the Indian judiciary machine, frequently criticized for delays and complicated approaches, requires a multi-faceted approach. Key strategies consist of: 1.Digitization and generation Integration: imposing e-courts and digital case management structures can streamline approaches, reduce papRead more

Enhancing the Indian judiciary machine, frequently criticized for delays and complicated approaches, requires a multi-faceted approach. Key strategies consist of:

1.Digitization and generation Integration: imposing e-courts and digital case management structures can streamline approaches, reduce paperwork, and enhance transparency. virtual hearings, already adopted in the course of the pandemic, need to be extended.

2. Growing Judicial potential: Appointing extra judges and establishing additional courts, mainly at the decrease degrees, can assist manage the caseload efficaciously. Specialised speedy-tune courts for precise kinds of instances, like the ones concerning women and children, also can expedite proceedings.

3. Judicial Reforms and schooling: non-stop training and ability building for judges and court docket team of workers in modern-day judicial practices and era can improve efficiency. Judicial responsibility mechanisms can make sure well timed delivery of judgments.

4. Alternative Dispute decision (ADR): selling ADR mechanisms like arbitration, mediation, and conciliation can reduce the load on courts. these methods offer faster, fee-powerful resolutions, especially for civil and commercial disputes.

5. Simplification of strategies: Reforming procedural legal guidelines to put off needless complexities and delays is important. This includes lowering adjournments and making sure stricter timelines for case disposal.

Enforcing these measures can assist create a greater green, obvious, and responsive judicial device in India.

See less