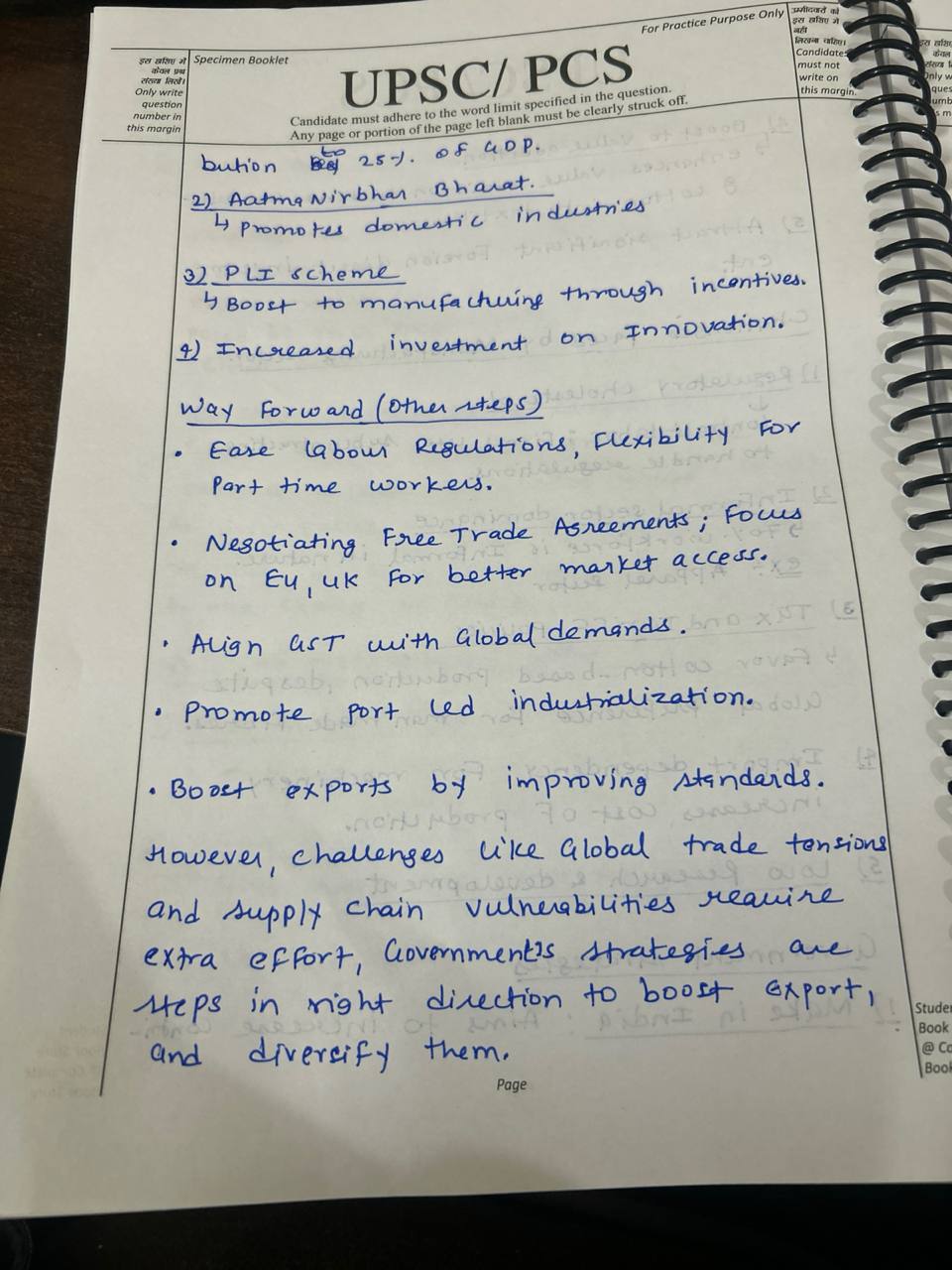

Examine the effects on foreign investment, the government’s emphasis on homegrown manufacturing, the development of indigenous capabilities, and the country’s investment landscape of the government’s drive for “Atmanirbhar Bharat” (self-reliant India). Also, talk about ways to strike a balance between ...

For U.S. Monetary Policy, as a part of Federal Reserve System (FED), Federal Open Market Committee (FOMC) is the primary decision making body and plays 6 important roles/functions which are as under :- 1. Forming Monetary Policies • Determining the appropriate monetary policies to achieve theRead more

For U.S. Monetary Policy, as a part of Federal Reserve System (FED), Federal Open Market Committee (FOMC) is the primary decision making body and plays 6 important roles/functions which are as under :-

1. Forming Monetary Policies

• Determining the appropriate monetary policies to achieve the Fed’s dual objective of price stability and maximum employment.

• It also provides evaluation of current economic & financial policies and forward guidance about the likely future path of monetary policies.

2. Communicating Monetary Policies

• The FOMC issues statements after each meeting, providing insights into its policy decisions and economic outlook.

• This communication assist in managing market uncertainty and ensures transparency to the public.

3. Conducting Open market operations

• Buying & selling government securities is the primary tool used by the FOMC to influence interest rates and the money supply.

• By Purchasing securities ensures liquidity into the banking system and lowers the federal funds rate, while vice versa in selling securities.

4. Influencing federal funds rates

• Federal Funds Rate is the interest rate that banks charge to each other for overnight loans.

• By adjusting this target, the FOMC can affect interest rates throughout the economy including mortgage, loans, etc.

5. Ensuring Economic Stability

• Boost economic activity by lowering interest rates to encourage borrowing and spending.

• Raising interest rates can slow down economic growth and reduce inflation.

6. Quantitative Easing (QE) and Tightening

• During financial crises, the FOMC may engage in unconventional monetary policy measures like Quantitative Easing (QE) & Tightening.

• In QE it buys large quantities of longer-term securities to lower long-term interest rates and stimulate the economy.

• In Quantitative Tightening it sells these securities to tighten monetary conditions.

See less

The "Atmanirbhar Bharat" (Self-Reliant India) initiative, launched by the Indian government in 2020, aims to strengthen India’s economic independence by enhancing domestic manufacturing capabilities, fostering innovation, and reducing reliance on foreign imports. This initiative has significant implRead more

The “Atmanirbhar Bharat” (Self-Reliant India) initiative, launched by the Indian government in 2020, aims to strengthen India’s economic independence by enhancing domestic manufacturing capabilities, fostering innovation, and reducing reliance on foreign imports. This initiative has significant implications for the country’s investment landscape, affecting foreign investment, domestic manufacturing, and the development of indigenous capabilities. Here’s an analysis of these implications and strategies for balancing self-reliance with global integration:

Implications for the Investment Landscape

1. Impact on Foreign Investment

Potential Effects:

Opportunities:

Challenges:

2. Focus on Domestic Manufacturing

Potential Effects:

Opportunities:

Challenges:

3. Development of Indigenous Capabilities

Potential Effects:

Opportunities:

Challenges:

Strategies to Balance Self-Reliance with Global Integration

1. Promote Strategic Global Partnerships

Strategy:

Benefits:

2. Implement Balanced Trade Policies

Strategy:

Benefits:

3. Foster Innovation and Skill Development

Strategy:

Benefits:

4. Enhance Infrastructure and Policy Support

Strategy:

Benefits:

Conclusion

The “Atmanirbhar Bharat” initiative aims to strengthen India’s economic independence by focusing on domestic manufacturing, innovation, and reducing reliance on foreign imports. While this push has significant implications for the investment landscape, including potential impacts on foreign investment and the development of indigenous capabilities, it also presents opportunities for growth and development.

Balancing self-reliance with global integration involves promoting strategic global partnerships, implementing balanced trade policies, fostering innovation and skill development, and enhancing infrastructure and policy support. By leveraging these strategies, India can achieve its self-reliance goals while remaining integrated into the global economy, supporting sustainable growth and development.

See less