Examine and evaluate the government’s efforts to improve tax administration and compliance, such as the introduction of the Goods and Services Tax (GST), in order to better understand how these changes will affect the efficiency and transparency of the tax ...

The Balance of Payments crisis in 1991 and the subsequent rise in inflation forced India to adopt wide-ranging reforms, popularly known as Liberalization, Privatization, and Globalization (LPG). The economic reforms of 1991 were a comprehensive structural overhaul of the Indian economy: LiberalizatiRead more

The Balance of Payments crisis in 1991 and the subsequent rise in inflation forced India to adopt wide-ranging reforms, popularly known as Liberalization, Privatization, and Globalization (LPG).

The economic reforms of 1991 were a comprehensive structural overhaul of the Indian economy:

- Liberalization

- Delicensing: The licensing requirement was done away with for most of the industries in a gradual manner and only a few industries are now reserved for the public sector (e.g. atomic energy generation).

- Relaxation under the Monopolistic and Restrictive Trade Practice (MRTP) Act: Now, it was no longer required to seek prior government approval for the expansion and establishment of new industries. The emphasis has shifted now to restricting unfair trade practices and safeguarding the interests of consumers.

- Liberalization of capital markets: Under the regulation of SEBI, a new company could be floated with the issuance of shares and debentures without seeking the permission of the government.

- Foreign exchange market: A flexible exchange rate has been introduced under which the exchange rate is determined by market forces. In 1993-94, the rupee was made fully convertible on trade accounts in terms of foreign currency.

- Removal of restrictions: Restrictions on mergers, takeovers, separation of industrial units, etc. have been largely removed.

- Privatization: The government started disinvestment by selling off the equities of the PSUs. The purpose behind such a move was to improve financial discipline and facilitate modernization. It helped the PSUs to gain from the efficient functioning of the private sector and improved decision-making at managerial levels.

- Globalization: This paved the way for the integration of the Indian economy with the global economy. In recent times, many services such as voice-based business processes (popularly known as BPO or call centers), record keeping, accountancy, banking services, music recording, film editing, book transcription, clinical advice, and even teaching are being outsourced by companies in developed countries to India.

With these reforms, the focus now has shifted from the earlier ‘License-Permit-Quota’ regime towards a regime under which the government plays the role of a facilitator and enables the private sector to play a proactive role in driving the economic development of India.

See less

Government Initiatives to Reform the Taxation System The Indian government has undertaken significant reforms in the taxation system, notably through the implementation of the Goods and Services Tax (GST) and various measures to improve tax compliance and administration. These initiatives aim to enhRead more

Government Initiatives to Reform the Taxation System

The Indian government has undertaken significant reforms in the taxation system, notably through the implementation of the Goods and Services Tax (GST) and various measures to improve tax compliance and administration. These initiatives aim to enhance the efficiency and transparency of the tax regime. Here’s an analysis of these reforms and their impact:

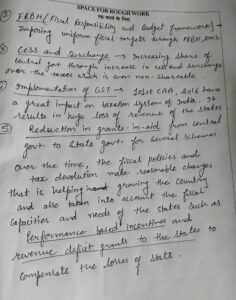

Implementation of the Goods and Services Tax (GST):

Objective: GST was introduced to simplify the tax structure, eliminate cascading taxes, and create a unified indirect tax system across India.

Key Features:

Single Tax Structure: GST subsumes multiple indirect taxes such as VAT, Service Tax, and Excise Duty into a single tax regime.

Input Tax Credit: Allows businesses to claim credit for the tax paid on inputs, thereby reducing the cascading effect of taxes.

Technology-Driven: GST implementation involves a robust online platform for tax filing, payment, and compliance.

Recent Examples:

E-Way Bill System: Introduced to streamline the movement of goods and ensure compliance, the e-way bill system has helped in reducing tax evasion and improving logistics efficiency.

GST Network (GSTN): Provides a digital platform for filing returns and managing compliance, which has been instrumental in automating and standardizing the tax process.

Impact:

Efficiency: GST has simplified the tax structure, reduced the complexity of compliance, and streamlined the process of tax collection. The unified tax regime has reduced the multiplicity of taxes and ensured a seamless flow of credit across the supply chain.

Transparency: The introduction of a digital platform for GST compliance has improved transparency and reduced the scope for tax evasion. The availability of real-time data has enhanced monitoring and enforcement capabilities.

Efforts to Improve Tax Compliance and Administration:

Objective: To enhance tax compliance, reduce evasion, and improve the efficiency of tax administration.

Key Initiatives:

Digitalization of Tax Services: The e-filing of Income Tax Returns and e-payment of taxes have simplified tax compliance for individuals and businesses.

Faceless Assessment and Appeals: Launched to minimize human intervention and ensure impartiality, faceless assessment aims to reduce corruption and enhance transparency.

Implementation of the Income Tax Act (Amendment) 2021: This includes provisions for reducing litigation, increasing transparency, and improving the efficiency of the tax administration process.

National Anti-Profiteering Authority (NAA): Established to ensure that the benefits of reduced tax rates under GST are passed on to consumers rather than being absorbed by businesses.

Recent Examples:

Tax Information Network (TIN): The TIN platform has facilitated the electronic filing of tax returns and the issuance of Tax Deducted at Source (TDS) certificates, improving the efficiency of tax collection and compliance.

GST Compliance Rating System: Implemented to evaluate and incentivize businesses based on their compliance with GST regulations, promoting adherence and reducing tax evasion.

Impact:

Efficiency: The digitalization of tax services has significantly reduced the time and effort required for tax compliance. Faceless assessments and appeals have streamlined administrative processes and reduced the burden on taxpayers.

Transparency: Improved transparency through digital platforms and faceless assessments has reduced opportunities for corruption and increased trust in the tax system. The data-driven approach has enhanced the accuracy of tax assessments and reduced disputes.

Evaluation of Impact

Efficiency and Simplification:

GST: The GST has simplified the indirect tax structure and created a more efficient system by integrating various taxes into a single framework. The input tax credit mechanism has reduced the cascading effect of taxes, benefiting businesses and consumers alike.

Digitalization and Faceless Services: These initiatives have streamlined tax administration, reduced paperwork, and minimized human intervention, leading to a more efficient and taxpayer-friendly system.

Transparency and Compliance:

GST Network and Compliance Rating: The GST network has enhanced transparency by providing a digital platform for compliance. The GST compliance rating system incentivizes businesses to adhere to tax regulations and reduces the scope for evasion.

Faceless Assessments: These have improved the fairness and transparency of tax assessments by minimizing opportunities for biased decision-making and corruption.

Recent Challenges and Areas for Improvement:

Implementation Issues: GST has faced challenges such as frequent changes in rates and technical glitches in the GSTN, which have impacted compliance and business operations.

Compliance Burden: Despite improvements, small businesses often struggle with the complexity of GST compliance. Efforts to simplify the process further and provide support to small enterprises are ongoing.

Conclusion

The Indian government’s initiatives to reform the taxation system, including the implementation of GST and improvements in tax compliance and administration, have significantly enhanced the efficiency and transparency of the tax regime. These reforms have simplified tax processes, reduced tax evasion, and created a more equitable and streamlined system. Continued efforts to address implementation challenges and further streamline compliance processes will be crucial for sustaining and enhancing the benefits of these reforms.

See less