Roadmap for Answer Writing 1. Introduction Start with a definition: Briefly introduce the concept of fiduciary duty in corporate governance. Example: “Fiduciary duty refers to the obligation of individuals in positions of trust, especially corporate directors, to act in the best interests ...

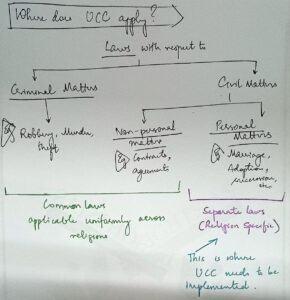

"It is a regret that Article 44 has remained a dead letter" said Justice Y V Chandrachud in Shah Bano judgement (1985). Our constitution-makers have placed 'Uniform Civil Code(Article 44)' under Directive principles of State Policy(Part IV). Need for UCC to balance diversity and ensure social justiRead more

“It is a regret that Article 44 has remained a dead letter” said Justice Y V Chandrachud in Shah Bano judgement (1985). Our constitution-makers have placed ‘Uniform Civil Code(Article 44)’ under Directive principles of State Policy(Part IV).

Need for UCC to balance diversity and ensure social justice

1) It enhances ‘Secularism’ – mentioned in Preamble and a part of Basic structure.

2) It is based on ‘Equality’ – a fundamental right (Article 14)

3) Personal laws are usually against women and marginal, vulnerable sections.

For example, Shariat – allows polygamy (Sarala Mudgal Case)

5) States like Goa, Uttarkhand have adopted UCC after legislative consensus

6) Supreme Court has supported its implementation in multiple instances.

Challenges to implement UCC

1. Article 26 provides for the right to manage one’s own religious matters.

2. Debate of – Fundamental Rights(Article 26) v/s DPSPs(Article 44)

3. STs have customary laws protected by the constitution itself.

4. Apprehensions of imposition of majoritarian values on minority

5. Accommodating diversity

Way forward

1) 22nd Law commission sought public consultation process on UCC

2) Consensus building that UCC is necessary

3) In the short-term personal laws can be codified phase-wise

4) UCC should not be imposed right away through an ordinance, it should pass through parliamentary debates and deliberations

5) Political parties should rise above differences for the common good of all

A fundamental change in people’s mindset is required for UCC’s implementation.

See less

Model Answer Fiduciary duty in corporate governance refers to the legal and ethical obligation of individuals, particularly the Board of Directors, to act in the best interests of the company and its stakeholders. In India, this concept is rooted in both statutory provisions and common law principleRead more

Model Answer

Fiduciary duty in corporate governance refers to the legal and ethical obligation of individuals, particularly the Board of Directors, to act in the best interests of the company and its stakeholders. In India, this concept is rooted in both statutory provisions and common law principles, which emphasize trust, transparency, and accountability within corporations.

Key Aspects of Fiduciary Duty

The duty of loyalty requires that directors act in the company’s best interest rather than their own personal interests. A prime example is avoiding self-dealing—such as entering into transactions that benefit a director personally, at the expense of the company or its shareholders. This principle is reinforced under Indian laws, including the Companies Act, 2013, which prohibits such conflicts of interest (Section 184).

Directors must provide full and accurate information to shareholders to enable them to make informed decisions. For example, Indian companies are required to disclose their financial performance through periodic reports such as the income statement and balance sheet. This aligns with the principle of transparency, a key aspect of corporate governance.

Directors must make decisions based on objectivity and independence, without undue influence from external factors or personal interests. This duty is reflected in the requirement under Indian corporate law for the appointment of Independent Directors (Companies Act, 2013, Section 149). These directors are expected to safeguard the interests of minority shareholders and provide unbiased oversight.

Directors must act honestly and with sincere intent to advance the company’s welfare. An example includes honoring contractual obligations even after the contract ends, ensuring that the company’s long-term interests are protected.

Directors are expected to make decisions with due diligence and care, ensuring that their actions support the company’s growth and risk management. This includes thoroughly evaluating strategic moves, such as mergers or acquisitions, and ensuring that the company’s assets are properly managed.

In conclusion, fiduciary duty in India ensures that directors act responsibly, transparently, and ethically, fostering trust and accountability in corporate governance. This concept is crucial for protecting the interests of stakeholders and sustaining the company’s long-term health.

See less