Examine the strategies the government has implemented to address the problems the Indian banking industry is facing, including the problem of non-performing assets (NPAs), the need for recapitalization, and the growing significance of digital banking.

Mains Answer Writing Latest Questions

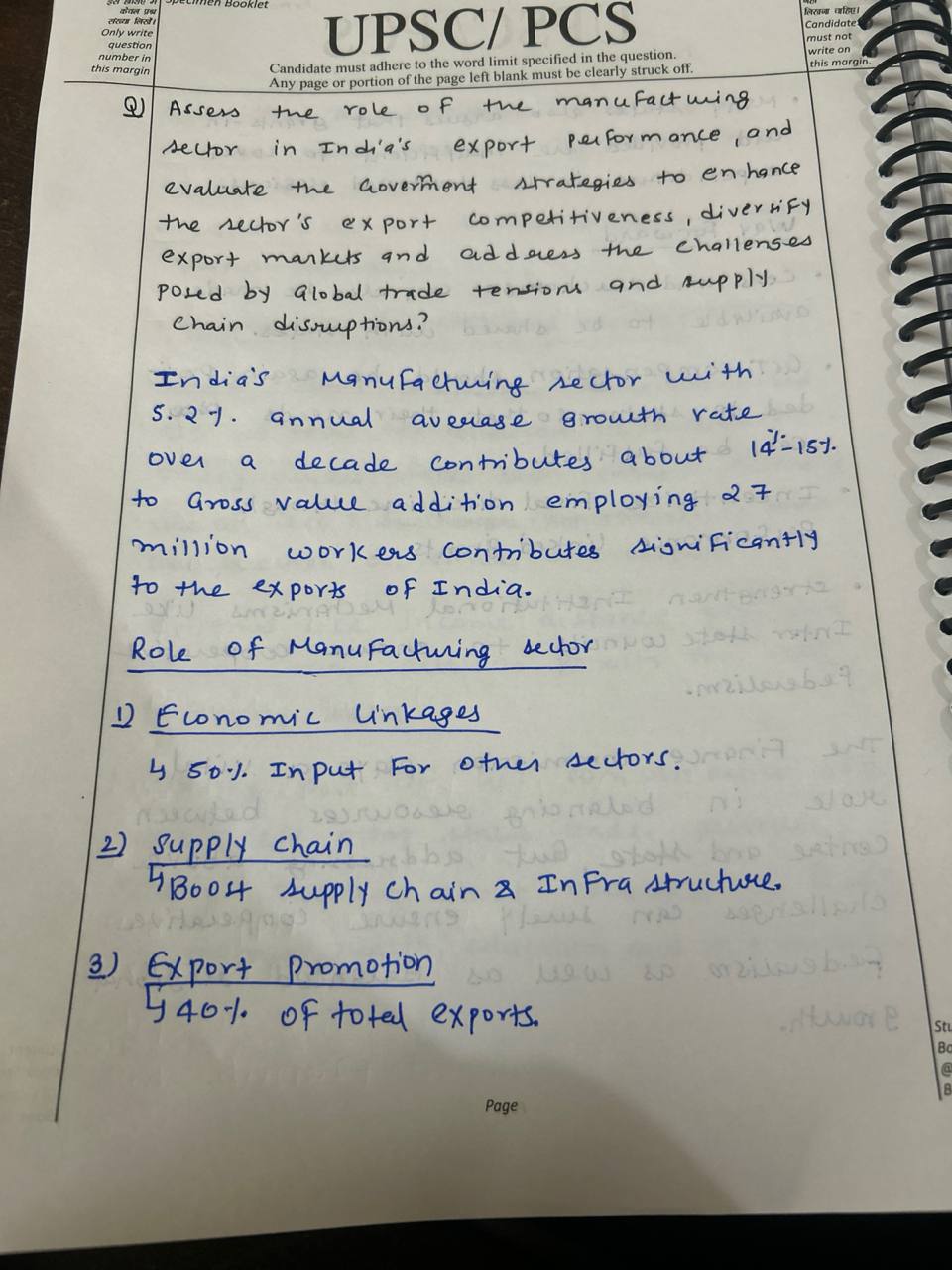

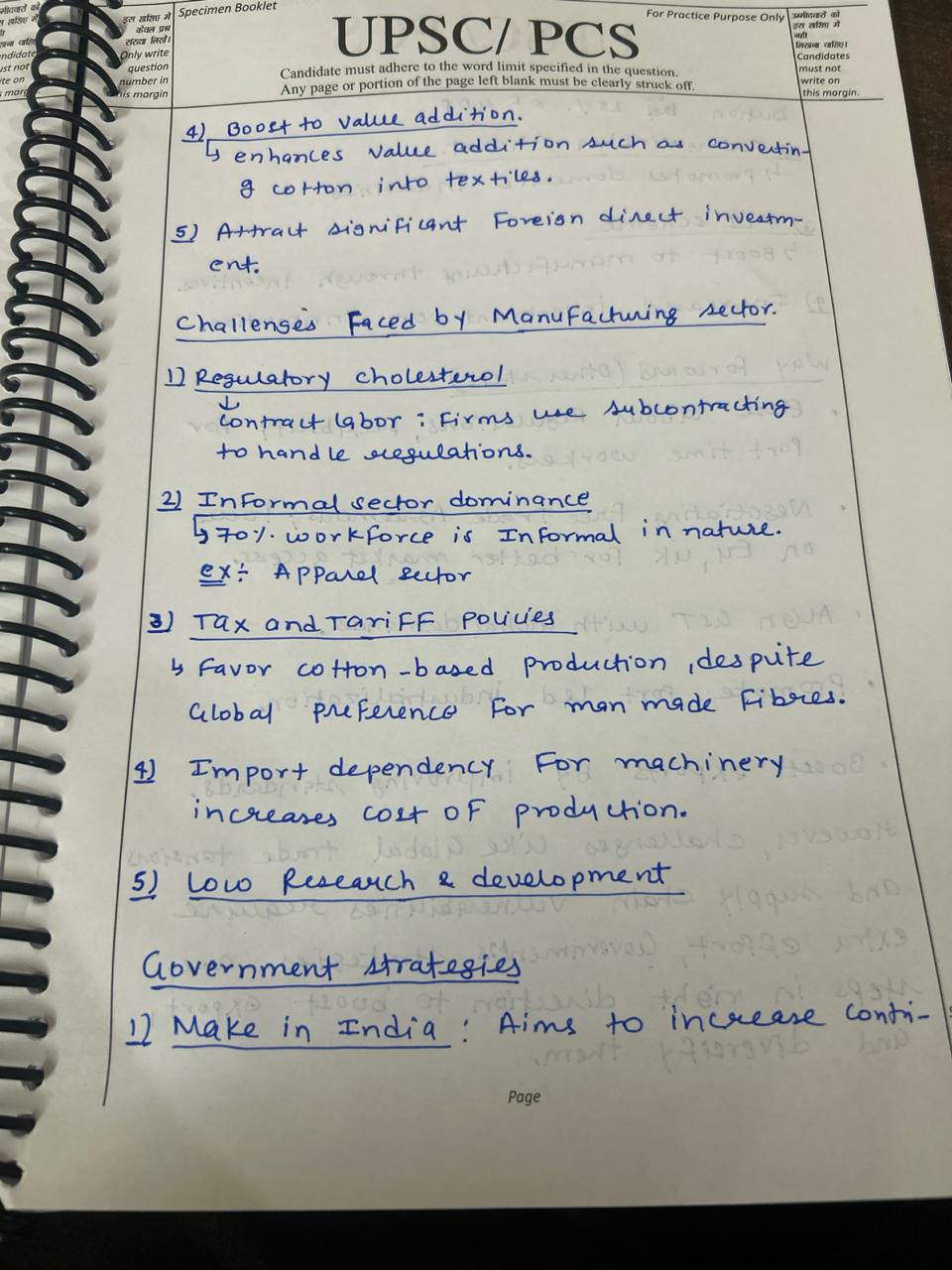

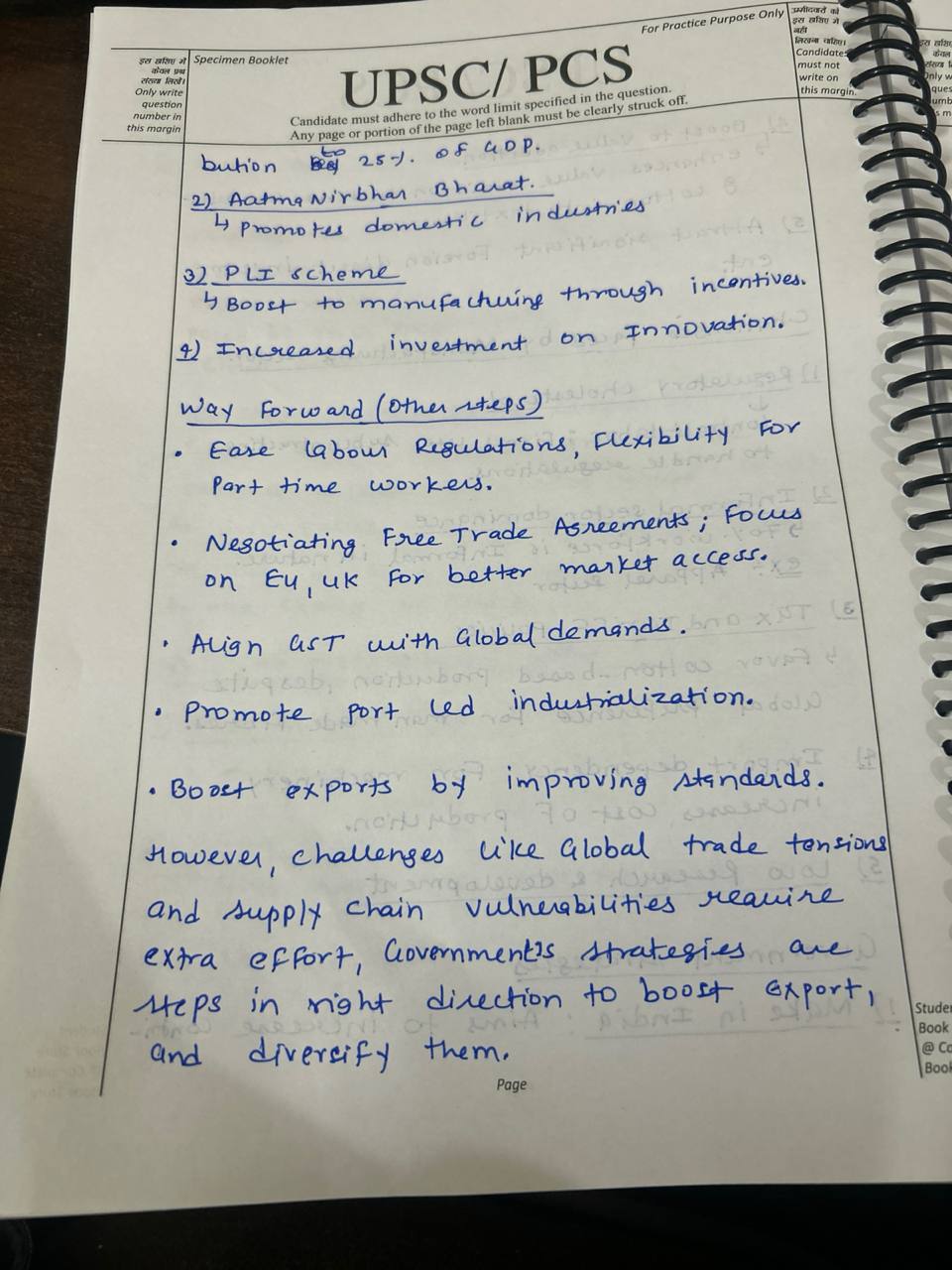

Analyze how the manufacturing sector contributes to India’s export performance and the government’s efforts to diversify export markets, increase the sector’s export competitiveness, and deal with supply chain disruptions and conflicts in the global trade arena.

Examine how the manufacturing sector fits into the “Atmanirbhar Bharat” (Self-Reliant India) initiative. You should also consider how import substitution, local value addition, and self-sufficiency affect critical sector performance, global competitiveness, and macroeconomic stability as a whole.

-

Role of the Manufacturing Sector in the "Atmanirbhar Bharat" (Self-Reliant India) Initiative Introduction The "Atmanirbhar Bharat" (Self-Reliant India) initiative, launched in May 2020, aims to enhance India's self-reliance by boosting domestic manufacturing and reducing dependency on imports. The mRead more

Role of the Manufacturing Sector in the “Atmanirbhar Bharat” (Self-Reliant India) Initiative

Introduction

The “Atmanirbhar Bharat” (Self-Reliant India) initiative, launched in May 2020, aims to enhance India’s self-reliance by boosting domestic manufacturing and reducing dependency on imports. The manufacturing sector plays a pivotal role in this initiative by focusing on import substitution, domestic value addition, and self-sufficiency in critical sectors. This discussion explores the role of manufacturing in the initiative and assesses the implications for the sector’s performance, global competitiveness, and overall macroeconomic stability.

Role of the Manufacturing Sector

Import Substitution

Objective and Policy Measures: The Atmanirbhar Bharat initiative emphasizes reducing reliance on imported goods by promoting domestic production. The government has introduced several policies to encourage import substitution, including higher import duties on certain products and incentives for domestic production. For example, the Automotive Industry has seen increased tariffs on imported vehicles and auto components, encouraging domestic manufacturers like Tata Motors and Mahindra & Mahindra to expand their production capacities.

Impact on Domestic Manufacturing: Import substitution policies have led to a rise in domestic production in several sectors. The electronics sector has benefited from initiatives like the Production Linked Incentive (PLI) Scheme, which incentivizes local production of electronics and reduces the dependency on imports. Companies such as Samsung and Apple have increased their local manufacturing footprints in India as a result.

Domestic Value Addition

Enhancing Value Chains: The initiative promotes domestic value addition by encouraging companies to establish or upgrade production facilities within India. The PLI schemes for various sectors such as textiles, pharmaceuticals, and automobiles are designed to enhance local value addition and production capabilities. For instance, Reliance Industries has invested in expanding its manufacturing of specialty chemicals and textiles in India, thereby adding value to its production processes.

Case Example: The Pharmaceuticals Industry has seen significant growth in domestic value addition due to the Atmanirbhar Bharat initiative. The PLI Scheme for pharmaceuticals has encouraged companies like Dr. Reddy’s Laboratories to increase their domestic production of essential medicines and APIs, thus reducing reliance on imports and enhancing local value chains.

Self-Sufficiency in Critical Sectors

Strategic Sectors: Achieving self-sufficiency in critical sectors such as defense, energy, and healthcare is a key objective of the initiative. The government has implemented policies to promote domestic production and reduce reliance on foreign suppliers. For example, the Defence Production and Export Promotion Policy aims to increase the indigenization of defense equipment and reduce imports.

Impact on Critical Sectors: Self-sufficiency efforts have led to increased domestic production capabilities in strategic sectors. The Defense Sector has seen the development of indigenous defense equipment like the Light Combat Aircraft (LCA) Tejas and Bharat Drone, enhancing national security and reducing import dependency.

Implications for Sector Performance, Global Competitiveness, and Macroeconomic Stability

Sector Performance

Growth and Expansion: Import substitution and domestic value addition have driven growth and expansion in the manufacturing sector. For example, the textile industry has seen increased production and export competitiveness due to support from the Atmanirbhar Bharat initiative and PLI schemes.

Challenges: While the initiative has spurred growth, there are challenges such as higher production costs and the need for significant investment in technology and infrastructure. Addressing these challenges is crucial for maintaining sector performance.

Global Competitiveness

Improved Competitiveness: By focusing on domestic production and reducing import dependency, Indian manufacturing is becoming more competitive globally. The electronics sector’s increased local production under PLI schemes has positioned India as a potential global hub for electronics manufacturing.

Export Potential: Enhanced self-reliance and improved production capabilities can lead to increased export opportunities. For instance, the pharmaceutical sector has not only reduced import dependency but also strengthened its position in the global market by exporting high-quality medicines and APIs.

Macroeconomic Stability

Reduced Import Bills: Import substitution contributes to macroeconomic stability by reducing the import bill and improving the trade balance. The increased domestic production of critical goods, such as electronics and pharmaceuticals, lowers the outflow of foreign exchange and supports economic stability.

Economic Resilience: Enhancing self-sufficiency in critical sectors builds economic resilience by reducing vulnerability to global supply chain disruptions. The self-reliance in defense production has strengthened national security and economic stability by mitigating risks associated with foreign supply dependencies.

Conclusion

The manufacturing sector’s role in the “Atmanirbhar Bharat” initiative is crucial for achieving import substitution, domestic value addition, and self-sufficiency in critical sectors. While these efforts have led to significant improvements in sector performance, global competitiveness, and macroeconomic stability, addressing associated challenges and ensuring continued investment in technology and infrastructure are essential for sustaining growth. The initiative is positioning India as a more self-reliant and competitive player in the global manufacturing landscape, contributing to long-term economic stability and growth.

See less

Consider the ways in which the government is attempting to empower the unbanked and underserved populations and enhance their access to financial services by means of expanding the Jan Dhan Yojana, offering microcredit and insurance, and utilizing digital platforms.

-

Government Efforts to Promote Financial Inclusion Financial inclusion is a critical component of economic development, aiming to provide access to financial services to all segments of the population, especially the unbanked and underserved. The Indian government has implemented several initiativesRead more

Government Efforts to Promote Financial Inclusion

Financial inclusion is a critical component of economic development, aiming to provide access to financial services to all segments of the population, especially the unbanked and underserved. The Indian government has implemented several initiatives to advance financial inclusion, including the expansion of Jan Dhan Yojana, the provision of micro-credit and insurance, and the use of digital platforms. This analysis examines these efforts and their impact on empowering marginalized groups and improving access to financial services.

1. Expansion of Jan Dhan Yojana

- Objective and Scope: Launched in 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to provide every household with a bank account. The initiative focuses on increasing access to banking services, including credit, insurance, and pension benefits.

- Recent Developments: As of 2024, PMJDY has successfully opened over 45 crore accounts. Recent enhancements include linking these accounts to the Aadhaar biometric system and expanding the range of services offered through these accounts, such as overdraft facilities and interest-bearing savings accounts.

- Impact on Financial Inclusion: PMJDY has significantly increased the number of bank account holders, providing a foundation for other financial services. The initiative has facilitated the transfer of subsidies and benefits directly to beneficiaries, reducing leakage and ensuring better financial management.

- Recent Example: In 2024, the government launched an integration of PMJDY accounts with the Direct Benefit Transfer (DBT) system, streamlining subsidy transfers and improving the efficiency of social welfare programs.

2. Provision of Micro-Credit and Insurance

- Micro-Credit Initiatives: Micro-credit programs aim to provide small loans to individuals, particularly in rural and semi-urban areas, who lack access to traditional banking services. The Pradhan Mantri Mudra Yojana (PMMY), launched in 2015, provides micro-loans to small entrepreneurs and businesses.

- Recent Developments: As of 2024, PMMY has disbursed loans worth over ₹12 lakh crore. Recent updates include the introduction of Mudra Credit Card (MCC), which offers flexible credit options and enhances access to working capital for small businesses.

- Insurance Schemes: The government has introduced several insurance schemes to promote financial security. The Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) offer affordable life and accident insurance to low-income households.

- Recent Developments: In 2024, the government expanded coverage under these schemes to include more beneficiaries and increased the sum assured. Additionally, the PMJJBY was linked with PMJDY accounts, providing automatic enrollment for account holders.

- Impact on Financial Inclusion: These micro-credit and insurance schemes have empowered individuals by providing financial resources for entrepreneurship and safeguarding against financial risks. They have improved economic stability and resilience among underserved populations.

3. Use of Digital Platforms

- Digital Financial Services: The adoption of digital platforms has revolutionized financial inclusion efforts. The Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts are linked with Digital Payment Systems such as Unified Payments Interface (UPI) and Aadhaar-enabled Payment Systems (AePS).

- Recent Developments: The government has promoted digital literacy and the use of mobile banking applications to increase access to financial services. The Digital India initiative supports these efforts by enhancing digital infrastructure and expanding internet connectivity.

- Recent Example: In 2024, the introduction of the Digital Rupee (Central Bank Digital Currency) is expected to further enhance financial inclusion by providing a secure and accessible means of digital transactions, especially for rural and underserved areas.

- Impact on Financial Inclusion: Digital platforms have made financial services more accessible and convenient, reducing barriers such as geographical distance and the need for physical bank branches. They have also promoted financial literacy and inclusion by providing users with easy-to-use financial tools and services.

4. Overall Impact and Challenges

- Empowerment of the Unbanked: Government initiatives have significantly empowered the unbanked and underserved populations by improving access to financial services, providing financial stability, and supporting entrepreneurship. These efforts contribute to economic growth and poverty reduction.

- Challenges: Despite the progress, challenges remain, including digital literacy gaps, infrastructure constraints, and issues related to the effective implementation of schemes. Addressing these challenges requires ongoing support, continuous monitoring, and targeted interventions.

Conclusion

The Indian government’s efforts to promote financial inclusion through programs like Jan Dhan Yojana, micro-credit and insurance schemes, and digital platforms have made substantial strides in improving access to financial services for marginalized populations. These initiatives have empowered individuals, supported economic activities, and enhanced financial stability. Continued focus on expanding coverage, addressing implementation challenges, and leveraging technology will be essential for achieving comprehensive and inclusive financial inclusion.

See less

Examine how well the government’s flagship initiatives—like the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), the National Rural Livelihood Mission (NRLM), and the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)—promote inclusive growth and lower poverty and income inequality.

-

Effectiveness of Government Flagship Programs in Promoting Inclusive Growth The Indian government has launched several flagship programs aimed at promoting inclusive growth and addressing poverty and income inequality. Key among these are the Mahatma Gandhi National Rural Employment Guarantee Act (MRead more

Effectiveness of Government Flagship Programs in Promoting Inclusive Growth

The Indian government has launched several flagship programs aimed at promoting inclusive growth and addressing poverty and income inequality. Key among these are the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), the National Rural Livelihood Mission (NRLM), and the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN). Analyzing the effectiveness of these programs involves examining their impact on rural development, poverty reduction, and income equality.

1. Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- Objective and Scope: Launched in 2005, MGNREGA provides a legal guarantee of 100 days of wage employment per year to rural households. It aims to enhance livelihood security, improve rural infrastructure, and promote inclusive development.

- Recent Developments: In response to the COVID-19 pandemic, MGNREGA saw increased demand as it provided a safety net for rural families facing economic distress. For example, during FY 2023-24, the program witnessed an unprecedented rise in work demand, with over 200 crore person-days of employment generated.

- Impact on Inclusive Growth: MGNREGA has significantly contributed to rural infrastructure development, such as the construction of roads, ponds, and irrigation facilities. It has also improved rural incomes and reduced migration by providing local employment opportunities. However, challenges remain, including delays in wage payments and concerns about the quality of assets created.

- Recent Example: In 2024, the government introduced a pilot scheme to digitize MGNREGA payments and improve transparency. This initiative aims to address issues related to delayed payments and enhance the program’s efficiency.

2. National Rural Livelihood Mission (NRLM)

- Objective and Scope: NRLM, launched in 2011, focuses on enhancing rural livelihoods by promoting self-employment and supporting rural poor through the formation of Self-Help Groups (SHGs). The mission aims to empower women and improve access to financial services.

- Recent Developments: As of 2024, NRLM has successfully facilitated the formation of over 70 lakh SHGs, benefiting more than 9 crore rural poor. The program supports these groups with training, financial literacy, and access to credit. In addition, NRLM’s focus on digital financial inclusion has improved access to banking services in remote areas.

- Impact on Inclusive Growth: NRLM has played a significant role in improving rural incomes and fostering entrepreneurship among marginalized communities. The program has also empowered women by providing them with financial independence and decision-making power.

- Recent Example: The introduction of the “Deendayal Antyodaya Yojana – National Rural Employment Guarantee Scheme (DAY-NRLM)” in 2023, which aims to integrate rural development programs, has streamlined efforts and improved the effectiveness of livelihood initiatives.

3. Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)

- Objective and Scope: Launched in 2018, PM-KISAN provides direct income support of ₹6,000 per year to small and marginal farmers in three equal installments. The scheme aims to provide financial assistance to improve agricultural productivity and reduce farmers’ financial stress.

- Recent Developments: As of 2024, PM-KISAN has been extended to cover over 11 crore beneficiaries. The scheme has been periodically updated to include more farmers and streamline disbursements. For example, the recent inclusion of tenant farmers and sharecroppers has expanded the program’s reach.

- Impact on Inclusive Growth: PM-KISAN has provided significant relief to small and marginal farmers, contributing to improved financial stability and agricultural productivity. The direct transfer of funds has helped farmers manage input costs and invest in agricultural practices.

- Recent Example: In 2024, the government announced an increase in the annual support under PM-KISAN to ₹8,000 to address rising input costs and inflationary pressures affecting farmers.

4. Overall Assessment and Challenges

- Impact on Poverty and Income Inequality: These programs collectively contribute to reducing poverty and income inequality by providing financial support, improving rural infrastructure, and enhancing livelihoods. They have empowered marginalized groups and created employment opportunities in rural areas.

- Challenges: Despite their successes, these programs face challenges such as administrative inefficiencies, delays in fund transfers, and issues with program implementation. Addressing these challenges requires continuous monitoring, improved governance, and better coordination between central and state authorities.

Conclusion

The flagship programs—MGNREGA, NRLM, and PM-KISAN—have been effective in promoting inclusive growth and addressing poverty and income inequality. They have improved rural livelihoods, provided financial support to farmers, and enhanced self-employment opportunities. However, to maximize their impact, ongoing reforms and improvements in implementation are essential. Continued focus on addressing challenges and optimizing program delivery will be crucial in achieving sustainable and equitable development.

See less

Challenges Faced by the Banking Sector in India 1. Non-Performing Assets (NPAs): Definition and Impact: High NPAs: Non-performing assets (NPAs) are loans or advances that have not been repaid by borrowers and have become overdue. High levels of NPAs strain the financial health of banks by reducing tRead more

Challenges Faced by the Banking Sector in India

1. Non-Performing Assets (NPAs):

2. Need for Recapitalization:

3. Growing Importance of Digital Banking:

Government Strategies to Address Banking Sector Challenges

1. Addressing NPAs:

2. Recapitalization Efforts:

3. Promoting Digital Banking:

Recent Examples and Outcomes:

Conclusion

The Indian banking sector faces several challenges, including high NPAs, the need for recapitalization, and the growing importance of digital banking. The government has implemented various strategies to address these challenges, such as recapitalization programs, the introduction of the IBC, and the promotion of digital banking. These efforts aim to enhance the stability and profitability of the banking sector, ensuring its resilience and capability to support economic growth.

See less