Given the speed at which India is becoming more urbanized, it is essential to use municipal bonds to satisfy the growing need for capital investment in urban areas. Talk about it. (Answer in 250 words)

Mains Answer Writing Latest Questions

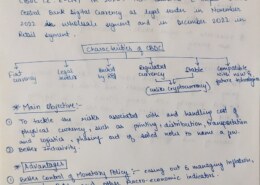

What is CBDC, or Central Bank Digital Currency? Talk about how implementing it in India will affect policy. (Answer in 150 words)

Recent projections indicate that the next ten years will see a surge in the Indian gig economy. Talk about the problems that gig workers in India face and the policies that need to be implemented to solve them in this ...

-

A NITI Aayog report estimates that more than 7.5 million workers were engaged in the gig economy in 2020-21 in India. This could grow to 23.5 million workers by 2029-30, making up for 4.1% of total livelihood in India. The Gig Economy holds a great significance in India, as it provides advantages liRead more

A NITI Aayog report estimates that more than 7.5 million workers were engaged in the gig economy in 2020-21 in India. This could grow to 23.5 million workers by 2029-30, making up for 4.1% of total livelihood in India. The Gig Economy holds a great significance in India, as it provides advantages like democratization of jobs, enhancing social inclusion, cost-effectiveness, enhancing income etc. However, as gig economy is growing rapidly, gig workers face many challenges as follows:

- Lack of technology diffusion: Lack of uniform access to internet services and digital technology acts as a restrictive factor for workers willing to take up jobs in the gig and platform sector.

- Job insecurity: Lack of job security, irregularity of wages, and uncertain employment status for workers are significant challenges faced by the gig workers. Further, there is no clarity on how and when incentive structures and advancement in jobs would be provided.

- Lack of social security: There is also the challenge of paid sick leave, health access and insurance due to lack of formalisation.

- Rising stress: This is due to uncertainty associated with regularity in available work and income. Also there is stress due to pressure from algorithmic management practices and performance evaluation on the basis of ratings.

- Lack of grievance redressal mechanism: There is no authority regulating the working conditions of gig workers. For instance, when Ola and Uber started cutting back incentives, the drivers in Mumbai decided to go on ‘strike’. But there was no clarity against whom they were holding strikes.

Faced with the above challenges, following policy measures for gig workers are needed:

- Increase access to institutional credit for gig workers and those interested in setting up their own platforms.

- Unsecured loans extended to first-time borrowers in the platform economy may be classified as Priority Sector Lending.

- Skill development of youth and workforce to make them employable. Platforms can enable the creation of potential “Skill Certificates” or “Skill Passports” for workers.

- Governments can ensure universal coverage of gig workers through the Code on Social Security.

- Various benefits like paid sick leaves, health access, insurance for gig workers, retirement /pension plans, occupational disease and other contingency benefits can be provided to gig workers.

Providing social security for the rising gig economy workers is the need of the hour. Many such steps are being taken in this direction like RAISE Framework for operationalizing the Code on Social Security (CoSS), 2020 and Centre & States have been asked to adopt a five-pronged approach to ensure realisation of full access to social security for all gig and platform workers when they draw up rules and regulations under the code.

See less

The internationalization of the rupee is not without risk, despite its many benefits. Talk about it. (Answer in 150 words)

-

In the process of internationalization of the rupee it comes with the multiple advantages like reduction in the dependence on the US dollar, enhancements in the globally trading Indian businesses and the most important strengthening of our economy. Promoting the rupee will also reduce the transactioRead more

In the process of internationalization of the rupee it comes with the multiple advantages like reduction in the dependence on the US dollar, enhancements in the globally trading Indian businesses and the most important strengthening of our economy. Promoting the rupee will also reduce the transaction costs which will benefit the Indian importers and the exporters.

But with every shift comes risk. Increasing exposures to financial markets globally can lead to greater unpredictability because the rupee would be more influenced by the international economical fluctuations. This would lead to higher inflation rates which will destabilize our domestic economy. Additionally the Indian financial system will face challenges in managing the liquidity as well as the exchange rate risks as we have relatively less developed financial infrastructure compared to other global currencies.

Furthermore, there’s also the risk of revengeful measures from the other powers of the economy which will perceive this internationalization of the rupee as an upcoming threat to their economy.

In conclusion, while internationalization of the rupee offers a variety of benefits but it comes with greater and parallel risks as well, so it requires careful management and risk mitigation techniques pre – planned to ensure that the advantages overpowers potential economic instabilites.

See less

Inadequacies in public spending have been brought to light repeatedly in audit reports concerning different development efforts in India. After identifying these inefficiencies, make recommendations for possible solutions. (Answer in 150 words)

-

Effective use of financial resources has been highlighted in the United Nations Sustainable Development Group (UNDG) Reference Guide as a critical dimension in the achievement of Sustainable Development Goals (SDGs). Further, in the SDG India Index, NITI Aayog has also recognised that financial resoRead more

Effective use of financial resources has been highlighted in the United Nations Sustainable Development Group (UNDG) Reference Guide as a critical dimension in the achievement of Sustainable Development Goals (SDGs). Further, in the SDG India Index, NITI Aayog has also recognised that financial resources are a fundamental driver for achieving the SDGs on time. However, audit reports on various development initiatives and the finances of the Center and states have frequently highlighted inefficacies in expenditure.

These include:

- Persistent non-spending of allocated funds: The persistent problem of unspent balances is a direct consequence of India’s broken governance structures (at various levels), which have been highlighted in various reports. For instance, a CAG report on the Clean Ganga Mission pointed to an unspent balance of approximately Rs. 2500 crores in 2017.

- Diversion and parking of funds: The CAG report of 2017 on performance audit of disaster management in Jammu and Kashmir reported that 25 percent of the expenditure meant for disaster mitigation purposes was diverted towards ineligible works.

- Irregular and wasteful expenditure: The CAG report in 2020 exposed several irregularities and wasteful expenditures to the tune of hundreds of crores by various Goa government departments.

- Misallocation/misutilisation of funds: Welfare schemes such as the Sarva Shiksha Abhiyan, Mid-Day Meal Scheme, PM Awas Yojana, Swachh Bharat Mission, etc. are riddled with misallocation and leakages. A Parliamentary Standing Committee report highlighted the issues of widespread corruption, insufficient funding and huge pending payments for wages in schemes like the MGNREGA.

The Voluntary National Review (VNR) Report and Three Year Action Agenda have listed out several measures for improving expenditure efficiency and effectiveness, which are as follows:

- Reorientation of the Budget with SDGs: Preparation of the Outcome Budget mandated since 2006-07 has not been as effective as envisaged and there is a need to reorient the Budget with SDGs. States like Haryana, Maharashtra, Assam etc. have taken some preliminary steps in this regard.

- Expenditure reforms: These include the following:

- Introduction of sunset clauses in all public expenditure programmes.

- Effective utilisation of the Public Financial Management System for tracking all expenditure flows.

- Rationalisation of schemes through merger and dropping of overlapping schemes.

- Use of technology like e-procurement and adoption of a Government e-Marketplace (GeM) model etc.

- Intervention at the stage of formulation of schemes: The schemes need to be formulated after adequate consultation with the state governments. There should be specific Ministry-wise Councils so that the Ministries formulate schemes in tandem with the existing state schemes for optimum utilization of resources.

- Need of an expert institution: The NITI Aayog or a body like the Centre-State Expenditure Commission can give directives and lay down the priorities with respect to expenditure.

In addition, improving efficiency of expenditure would need to be established through suitable audits. Further, a decentralized and local approach can help in achieving efficiency while incurring expenditure.

See less

Explain the idea of multidimensional poverty and list the steps India has made to address this issue. (Answer in 200 words)

-

Multidimensional poverty, going beyond the income criteria, measures poverty deprivation in three key areas - living standards, education and healthcare, that a poor person simultaneously faces. Recently, the NITI Aayog has released the 'National Multidimensional Poverty Index: Baseline Report and DRead more

Multidimensional poverty, going beyond the income criteria, measures poverty deprivation in three key areas – living standards, education and healthcare, that a poor person simultaneously faces. Recently, the NITI Aayog has released the ‘National Multidimensional Poverty Index: Baseline Report and Dashboard’.

The Multi-dimensionality Poverty Index (MPI) serves as a better model than income criteria to identify poor persons due to the following reasons:- Multidimensional approach: The MPI takes advantage of the availability of multipurpose household surveys, which allow data on different dimensions to be drawn from the same survey. They identify the people who experience overlapping deprivations.

- Better comparison: The MPI can show the prevalence of multidimensional poverty across different regions, ethnic groups or any other population sub-group.

In this context, the following steps have been taken to help reduce multidimensional poverty in India:

- Child mortality:

- Janani Suraksha Yojana (JSY) and Janani Shishu Suraksha Karyakaram (JSSK) have been launched to promote institutional deliveries through cash incentives.

- India Newborn Action Plan (INAP) was launched in 2014 to ensure attainment of the goals of “Single Digit Neonatal Mortality Rate” and “Single Digit Stillbirth Rate,” by 2030.

- The Reproductive, Maternal, Child and Adolescent Health programme (RMNCH+A) encompasses all interventions aimed at reproductive, maternal, newborn, child, and adolescent health under a broad umbrella.

- Universal Immunization Programme (UIP) was launched to provide vaccination to children against life threatening diseases. Similarly, “Mission Indradhanush and Intensified Mission Indradhanush” have been launched to immunize children who are either unvaccinated or partially vaccinated.

- Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) provides fixed-day assured, comprehensive and quality antenatal care universally to all pregnant women.

- Rashtriya Bal Swasthya Karyakram (RBSK) provides comprehensive care to all the children in the age group of 0-18 years in the community.

- Nutrition:

- Various schemes like the National Nutrition Mission, PM- POSHAN (Mid Day Meal) scheme etc. have been launched with the aim of tackling the malnutrition problem prevalent in India.

- Nutrition Rehabilitation Centres (NRCs) have been set up at public health facilities to treat and manage the children with Severe Acute Malnutrition (SAM).

- Iron and Folic Acid (IFA) supplementation for prevention of anaemia among the vulnerable age groups and home visits by ASHAs to promote exclusive breastfeeding.

- Health and nutrition education through Information, Education & Communication (IEC) and Behavior Change Communication (BCC) is being carried out.

- Education:

- Various schemes like Sarva Shiksha Abhiyan, Mahila Samakhya Programme, Scheme of Vocational Education, scholarships schemes for vulnerable sections, various fellowships etc. are being provided.

- The New Education Policy 2020 has been launched to ensure ‘universal access at all levels of school education’.

- Living Standards:

- Swachha Bharat Abhiyan aims to ensure cleanliness and sanitation.

- Pradhan Mantri Awas Yojana is aimed at providing housing for all.

- Swajal Sheme has been launched to provide clean drinking water.

- PM Ujjawala Yojana has been launched to provide clean cooking fuel.

- Under Pradhan Mantri Sahaj Bijli Har Ghar Yojna (SAUBHAGYA), electricity connections were started for BPL families for free and other families at concessional rates.

Apart from the above mentioned initiatives, the government should focus on accelerating economic growth, agricultural growth, human resource development and infrastructure development, implementation of Universal Basic Income, capacity development of government officials etc., which will help India achieve its Sustainable Development Goal 1 i.e. end poverty in all its forms everywhere.

See less

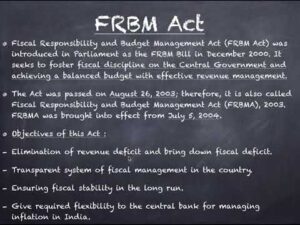

What goals does the Fiscal Responsibility and Budget Management Act of 2003 (FRBMA) seek to achieve? List the salient qualities of it. (Answer in 200 words)

-

This answer was edited.

The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA):- This act aims to bring the discipline in the government's finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public) The Objectives of the (FRBMA) ACT,2003 are as follows : ItRead more

The Fiscal Responsibility and Budget Management Act, 2003

(FRBMA):-

(FRBMA):-This act aims to bring the discipline in the government’s finance, reduce fiscal deficit, and improve macroeconomic management (improve the management of funds with public)

The Objectives of the (FRBMA) ACT,2003 are as follows :

- It reduces the Fiscal deficit: It sets targets to gradually bring down the government budget deficit. This aims for the more balanced budget.

- It eliminates a Revenue Deficit: This Act also targets on the elimination of the revenue deficit, where government spending exceeds its income. This act ensures that the Government should not rely on the borrowings to meets its expenses.

- It enhances the fiscal transparency: This act Promotes the transparency among the public by disclosing their fiscal targets and achievements. This enhances the public trust.

- It ensures debt sustainability: This Act, enables the limit on the total liabilities as a percentage of GDP (Gross Domestic Product) for the government. This act secures the upcoming generations from the excessive burden of the debt.

- It promotes macroeconomic stability: By achieving the above objectives, this act fosters to create more stable and growing economy of a country.

Functions of (FRBMA) ACT, 2003 are as follows :

- Reduce Fiscal Deficit: This act lay out specific targets for reducing Fiscal and Revenue deficit over a medium-term period. The targets are reviewed and examined periodically.

- Medium-Term Fiscal Policy statement: The government is obligated to present a medium-term fiscal policy statements which outlines it’s fiscal strategy and future projections.

- Escape cause: It sometimes allows the deviations from the targets only during the exceptional cases like natural disasters or economy downfall.

- fiscal council: An independent Fiscal Council es initially formed by this act to monitor the government’s loyalty to the targets formed by FRBMA (Fiscal Responsibility and Budget management Act.)

I am enclosing an image which describes this matter in a more significant manner and the language used is too easy to understand.

See less

What is sterilization, in your opinion? How does the RBI guard against outside shocks by stabilizing the money supply? (Answer in 200 words)

-

Sterilization refers to the process by which a central bank offsets the effects of foreign exchange interventions on the domestic money supply. When a central bank buys or sells foreign currency to influence exchange rates, it affects the amount of domestic currency in circulation. To neutralize thiRead more

Sterilization refers to the process by which a central bank offsets the effects of foreign exchange interventions on the domestic money supply. When a central bank buys or sells foreign currency to influence exchange rates, it affects the amount of domestic currency in circulation. To neutralize this impact and maintain control over domestic monetary conditions, the central bank conducts sterilization operations.

The Reserve Bank of India (RBI) uses sterilization to stabilize the money supply against external shocks. When there is an influx of foreign capital, leading to an increase in foreign exchange reserves, the RBI might sell government securities to absorb the excess liquidity. Conversely, if there is an outflow of foreign capital, causing a reduction in foreign exchange reserves, the RBI might buy government securities to inject liquidity into the system. This ensures that the money supply remains stable despite external capital flows.

By managing the liquidity through open market operations (OMOs), the RBI can control inflation and interest rates, thereby stabilizing the economy. This is crucial for maintaining economic stability, as uncontrolled fluctuations in the money supply can lead to inflation or deflation, adversely impacting growth and financial stability.

See less

What are assets that do not perform (NPAs)? Describe the steps the government has recently made to combat the threat posed by non-performing assets (NPAs) in India. (Answer in 200 words)

-

This answer was edited.

NPA stands for Non-performing assets (NPAs). As per the Reserve Bank of India NPAs are loans or advances, due for more than 90 days. In other words, an asset becomes non-performing when it stops generating income for the bank. In case of agricultural advances cropping seasons are taken into cRead more

NPA stands for Non-performing assets (NPAs). As per the Reserve Bank of India NPAs are loans or advances, due for more than 90 days. In other words, an asset becomes non-performing when it stops generating income for the bank. In case of agricultural advances cropping seasons are taken into consideration instead of 90 days. Increasing NPAs is not a good sign for the banking sector and economy as it shows the inability of people to repay the loan.

Types of NPAs

Non-performing assets are categorized into various types based on specific criteria.

1. Substandard Assets: The assets have remained NPA for a period less than or equal to 12 months.

2. Doubtful Assets: Assets that have remained in the substandard category for 12 months.

3. Loss Assets: Assets where loss has been identified by the bank or external auditors or the RBI, but the amount has not been written off.

Measures Taken to Control NPAs by the Government

1. Insolvency and Bankruptcy Code (IBC), 2016:

It aims to improve the ease of doing business and a single-step solution to resolve insolvency issues.

To oversee the implementation of the law and insolvency professionals.

The incorporation of the IBC has significantly improved the recovery rates of bad loans by providing quicker resolution and restructuring of assets.

2. Asset Quality Review (AQR):

The RBI introduces an AQR to identify stressed assets in the banking system. This exercise focused on bringing transparency and improving the recognition of NPAs on the bank’s books.

3. Strategic Debt Restructuring (SDR), 2015:

If corporations are unable to repay their bank loans, the banks have the option to convert part or all of the loans into equity shares.

4. Mission Indradhanush:

This initiative was launched to revise the functioning of PSBs and identify issues like accountability, governance, and the overall condition of the banking sector.

It includes appointing professionals to major positions, empowering risk control measures, and improving the efficiency of bank operations.

5. Debt Recovery Tribunal (DRT), 2013:

It is governed by the Recovery of Debt Due to Banks and Financial Institutions Act, of 1993.

The aim was to shorten the time needed for case settlements.

6. Joint Lenders Forum (2014):

This measure is implemented to prevent the situation where a loan is taken from one bank to repay loans from other banks.

7. 5:25 Rule (2014):

It is also known as the Flexible Restructuring of Long Term Project Loans to Infrastructure and Core Industries and involves the refinancing of long-term projects.

8. Corporate Debt Restructuring (2005):

It minimizes the company’s debt burden by extending the repayment period and lowering the interest rates.

9. Asset Reconstruction Companies (ARC)

This measure helps in recovering value from distressed loans without going through the time-consuming process of court.

10. The SARFAESI Act (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act), 2002:

This act allows banks and financial institutions to auction residential or commercial properties to recover loans of defaulters.

The amendment in 2016 aimed to encourage banks to take possession of collateral security and sell them without the interference of courts.

11. Bad Bank – National Asset Reconstruction Company Limited (NARCL):

The government suggested setting up a ‘bad bank’ to manage and dispose of stressed assets of banks.

It will facilitate the aggregation and resolution of large-value NPAs along with the India Debt Resolution Company Limited (IDRCL).

12. Empowering Governance in Banks:

It includes the establishment of the Banks Board Bureau (BBB) to recommend appointments of directors and ensure the professionalization in bank management.

Improved investigation and accountability norms to avoid the reoccurrence of large frauds.

13. One-Time Settlement Schemes:

Banks have been encouraged to offer one-time settlement schemes to borrowers, especially in the MSME sector, to expedite the recovery process.

14. MSME Debt Restructuring:

The government and RBI have provided relief to the MSME sector by allowing the restructuring of their stressed assets without devaluing them.

See less

Although the digitalization of land records is a good thing, there are certain issues that must be resolved. (Answer in 200 words)

-

Access to land is a critical factor for economic growth and poverty reduction. For government, industry, and citizens to be able to use this asset effectively and to minimize land conflicts, digitization can help by improving access to reliable land and property records. Advantages of digitization oRead more

Access to land is a critical factor for economic growth and poverty reduction. For government, industry, and citizens to be able to use this asset effectively and to minimize land conflicts, digitization can help by improving access to reliable land and property records.

Advantages of digitization of land records:

- Reduction in litigations and burden of cases: A NITI Aayog paper suggests that land disputes on average take about 20 years to be resolved. Land disputes add to the burden of the courts and impact sectors and projects that are dependent on these disputed land titles.

- Promoting agricultural credit: Land is often used as collateral for obtaining loans by farmers. Digitization of land records and online creation of equitable mortgages would help in faster disbursement of agriculture credit.

- Development of new infrastructure: The economy of the country is shifting from agrarian to manufacturing and services-based. However, several new infrastructure projects are witnessing delays due to a lack of updated land records.

- Urbanization and housing: Slum dwellers do not have access to a clear land title or ownership rights. Further, since many colonies in which the poor reside are unauthorized, it is difficult for Urban local bodies to provide basic services to them. Easier online approvals of plans and occupancy certificates will provide clarity over ownership status.

- To check benami transactions: Unclear titles and non-updated land records enable carrying out property transactions in a non-transparent way. The Standing Committee on Finance in 2015 noted that the generation of black money through benami transactions could be eliminated by the digitization of land records and their regular updation.

Challenges Faced in Digitization of Land Records:

- Lack of unified legal framework: The system of land records was inherited from the Zamindari system. The legal framework in India does not provide for guaranteed ownership, and how information about land records is collected and maintained further exacerbates the gaps in these records.

- Land unavailability in the development of infrastructure: These delays occur because of non-availability of encumbrance-free land, non-updation of land records, resistance to joint measurement survey of land records, demands for higher compensation by landowners, and filing of large number of arbitration cases by landowners.

- Lack of manpower: One of the major roadblocks in ensuring continuous updation of land records is the lack of skilled manpower in the land record departments of states.

- Poor synergy across land record departments: The Revenue department is the custodian of textual records; the survey and the settlement departments manage the spatial records and the registration department responsible for registering land transactions, lacks synergy in functioning.

- Digital divide: Lack of awareness and digital illiteracy are prevalent, especially in rural areas.

To address these challenges, there is a need for wider adoption of technologies such as geographical information systems, data warehouses, and webs. It would help in making land records management efficient and easier for decision-making, strategy planning, and productive modeling. Also, an online or digital record department could be established for the betterment of online land records maintenance.

See less

According to the World Urbanization Prospects, 2018, more than 50% of India's population will be urban by 2050. By some estimates, India needs to build a Chicago every year and is expected to see an influx of population the size of the entire USA into its cities over the next decade. A new World BanRead more

According to the World Urbanization Prospects, 2018, more than 50% of India’s population will be urban by 2050. By some estimates, India needs to build a Chicago every year and is expected to see an influx of population the size of the entire USA into its cities over the next decade. A new World Bank report (2022) estimates that India will need to invest $840 billion over the next 15 years- or an average of $55 billion per annum-into urban infrastructure if it is to effectively meet the needs of its fast-growing urban population. Further, the National Infrastructure Pipeline (NIP) envisages Rs. 19 trillion of investments in urban India over a five-year period till FY25. However, the current urban financing system is plagued with several challenges. For instance, the devolution of funds to the Urban Local Bodies (ULBs) from the state is not predictable and timely. Further, these devolved funds are largely tied in nature, to either specific sectors or schemes. The ULBs contribute only about 1% of India’s GDP as their revenue share often does not rise with the economic growth of an area due to factors like undervaluation of land and limits on taxation power. In this context, successful listing of municipal bonds by more than 10 cities in India is a silver lining. Most recently, Vadodara has raised Rs 100 crore and has also been selected by the US Embassy and Treasury for a case study on successful listing and a benchmark for other civic bodies.

Significance of municipal bonds:

Despite its significance, urban financing through municipal bonds cannot be considered as a one stop solution for urban infrastructure financing due to the following reasons:

Thus, municipal bonds can help to pay for vital capital projects-roads, energy, water, sanitation, and other essentials-but there is a requirement of strict implementation of SEBI regulations on municipal bonds, having a specialized agency to protect bond-holders in cases of default (like in Denmark), and adoption of best accounting practices.

See less